Nifty Tricks for Fixing Credit Score Errors

Tips for improving your credit score quickly is a guide to minimizing credit card score errors to influence your financial life positively.

Introduction

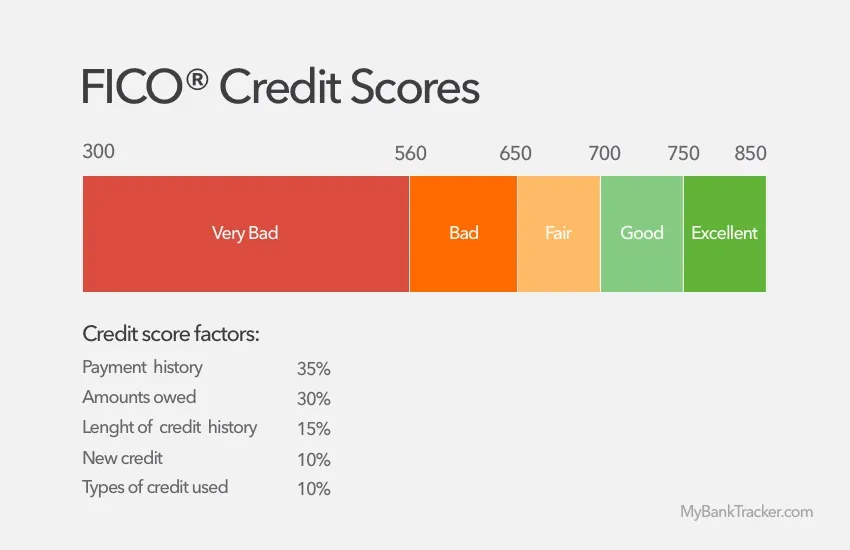

Ever wonder why tips for improving your credit score quickly are important? The most viable answer to this question is that improving the score helps you achieve financial goals like housing, loans, insurance, jobs, and car leases. Usually, when your scores aren’t in good shape, you will have to pay more security deposit for the services and products. As credit score reflects your ability to manage debts, higher scores make you appear a responsible and reliable consumer. A score of 800 or above is usually considered an excellent score to showcase your financial management abilities. With strategic planning and financial discipline, achieving a high credit score isn’t that impossible.

Tips for Improving your Credit Score Quickly

Here is a list of some cool tips and tricks to enhance your credit score to achieve optimum financial goals.

1. Keep a Keen Eye on the Annual Credit Report

Your annual report card is more than a formality. You can grab a free copy from credit bureaus such as Equifax, Experian, and TransUnion, every time it needs to be read thoroughly to check for errors or fraudulent activities. The errors and maleficent activities require immediate redressal for quick compensation.

2. Slash Credit Card Balances

Tips for improving your credit card score quickly also recommend that you utilize no more than 20% of your balance and the percentage should remain the same even if you are using multiple credit cards as the strategy has a significant impact on your credit score. Secondly, it also recommended to prioritize paying the high-interest rate debts first to reduce overall loss.

3. On-Time Payments

One of the most recommended tips for improving your credit score quickly is to never cross the deadline for the dues payments. You can either set up the payments of the dues on automatic mode or ask the concerned bank to issue you payment reminders via messages or email alerts.

4. Be an Authorized User

Being an authorized user on the credit card of a family member or a friend helps you benefit from their high credit score and credit card history. But before you give your consent to be an authorized user, make sure that the primary cardholder has a positive credit card history and a high credit score.

5. Request for More Credit Limit

The request for an increase in credit card limit is to keep the expenditure minimum, but you need to be cautious not to overspend just because you have an increased balance. The idea of raising the credit limit is to decrease the credit utilization ratio.

6. Multiple Payments within a Month

One of the most effective tips for improving your credit score quickly is to try to pay for the credit on various occasions within the month. It will help keep your credit utilization ratio on a lower ladder and your credit score on a higher one.

7. Keep up the Old Accounts

One of the most important tips for improving your credit score quickly is to keep managing your old accounts, as lengthy credit history always matters and proves beneficial in the long run, even if you no longer use it.

8. Relinquish Defaulted Accounts

Prioritize settling score for over-due accounts first by negotiating with the creditor to remove the negative score even if it requires you to pay. Try to convert the negotiation into written formal documents for future reference.

Also Read: How to Start an Event Space Business with No Money

9. Leverage Experian Boost or Equivalent Services

One of the most recommended tips for improving you credit score quickly is to try making various payments like utility bills and phone bills through your credit card to increase your score but it is equally important to make the payments for credit within the timeframe of credit card requirements.

10. Slash Hard Inquiries

Avoid applying for credit until it is absolutely necessary, as they might result in hard inquiries that never look good on the credit score.

Tips for improving your credit score quickly suggest wisely planning your financial goals for noticeable improvements.