Table of Contents

UK long-haul transport accounts for around 90% of goods moved by road, with heavy goods vehicles (HGVs) carrying 229 billion vehicle-kilometres per year. Decarbonising this sector is central to the UK’s net-zero strategy for 2050. Renewable fuels and hydrogen are the two stand-out alternative energy pathways under active policy review and industry trials.

The Renewable Transport Fuel Obligation (RTFO) now mandates that nearly 8% of all supplied road fuel be renewable, delivering average lifecycle greenhouse gas savings of around 80% compared to fossil diesel in 2024. Biofuels such as hydrotreated vegetable oil (HVO) and biodiesel are already in use, blending into existing fuels and delivering immediate carbon savings while infrastructure evolves.

Hydrogen holds strong long-term potential due to its high energy density and zero tailpipe emissions, but industry evidence suggests it is unlikely to be a practical choice for vehicles purchased today, given current technological, infrastructure, and market barriers. The future of UK long-haul transport will likely rest on balancing near-term carbon reduction with biofuels, while preparing for hydrogen’s scale-up over the 2030s.

How Biofuels Are Shaping UK Logistics

Biofuel Contributions and Policy

Biofuels support UK long-haul transport by reducing carbon without replacing vehicles or fuelling systems. Under the RTFO, UK suppliers must meet rising renewable fuel quotas; by 2030, this obligation is due to reach nearly 19.5% of all supplied transport fuel. Renewable fuels supplied in 2024 totalled 3,809 million litres equivalent, maintaining an 8% share of all road and non-road fuel use in the UK.

These fuels achieved an average 80% reduction in lifecycle greenhouse gases compared with fossil diesel, or 77% when indirect land-use change is included. Waste-derived feedstocks supplied 77% of verified renewable fuel in 2024. These results clearly show biofuels are already providing measurable carbon savings across UK freight operations, highlighting the role of Sustainable Logistics in reducing the sector’s environmental impact.

HVO and Performance in Freight Fleets

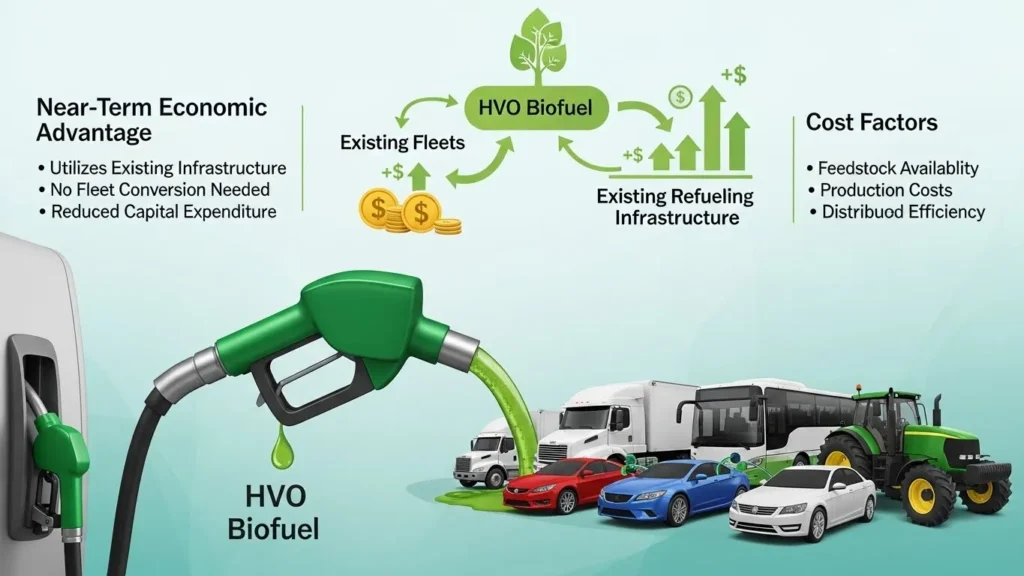

Hydrotreated Vegetable Oil (HVO) is a key biofuel for UK long-haul transport because it can be used in existing diesel engines with no modifications. HVO is produced from waste vegetable oils, animal fats or used cooking oils and delivers up to 90% carbon savings compared with fossil diesel when lifecycle emissions are considered. Truck manufacturers are increasingly specifying HVO compatibility in new diesel-engine models.

This “drop-in” quality reduces transition costs and helps fleets report immediate carbon cuts in their Carbon Reporting metrics. Over the mid-term, expanding HVO supply and sustainable feedstock availability will determine its wider adoption in logistics.

Hydrogen’s Potential and Current Limitations

Hydrogen Advantages and Challenges

Hydrogen fuel has significant theoretical advantages for UK long-haul transport: high gravimetric energy density and zero tailpipe emissions when produced from renewable sources. In fuel cell trucks, hydrogen can deliver ranges similar to fossil diesel and refuel in minutes rather than hours, a valuable trait for long-distance freight.

However, recent academic analysis concludes hydrogen is unlikely to be feasible within the lifespan of vehicles bought today. The main issues are sparse refuelling infrastructure, high production costs, and the need for industry-wide investment in supply chains and technology. Hydrogen’s potential is strongest in the 2030s and beyond as renewable hydrogen capacity expands and costs fall.

Infrastructure and Policy Signals

The UK government’s hydrogen strategy sets an ambition of developing 10 GW of low-carbon hydrogen production by 2030 to support multiple sectors, including transport. Long-haul logistics infrastructure must include hydrogen refuelling stations and storage facilities along key freight corridors.

Current hydrogen refuelling stations are limited, and most hydrogen in the UK still comes from natural gas rather than green electrolysis. Public and private funding for hydrogen hubs and supply chain development will be necessary before hydrogen is widely used in UK long-haul fleets, complementing efforts in the Electric Fleet Transition.

Cost and Operational Comparison

Cost factor Biofuels such as HVO have a near-term economic advantage because they can be used in existing fleets and refuelling infrastructure. Hydrogen currently remains more expensive, both in production and deployment of infrastructure. This cost differential limits hydrogen’s competitiveness, although future economies of scale could change that. Operational factor Biofuels support immediate emissions reductions with minimal disruption.

Hydrogen offers operational benefits, including fast refuelling, but only once infrastructure and supply chains scale meaningfully. Market factor UK policy actively promotes renewable fuels today through RTFO mandates and carbon reporting requirements, making biofuels a practical choice for logistics operators now. In contrast, hydrogen policy focuses on future long-term potential with infrastructure goals and production targets that extend into the next decade.

Real Case: Biofuels in UK Public Sector Fleets

In 2025, the Royal Air Force trialled Hydrotreated Vegetable Oil (HVO) fuel across its transport fleet. The five-month test demonstrated reliable performance across diverse operational conditions and reinforced the idea that drop-in biofuels can deliver significant carbon savings immediately, without costly engine modifications. This case shows how public fleets are adopting biofuel to meet decarbonisation targets while hydrogen infrastructure is still emerging.

The RAF trial also influenced Dorset Council’s decision to switch its heavy vehicle fleet entirely to HVO, expecting up to a 90% reduction in emissions compared with fossil diesel. This real-world trial highlights how UK logistics operations are already benefitting from biofuels.

Table: Key Attributes of Biofuels vs Hydrogen for UK Long-Haul Transport

| Attribute | Biofuels (e.g. HVO, biodiesel) | Hydrogen (Fuel Cell) |

|---|---|---|

| Carbon Reduction Potential | Up to ~90% lifecycle savings | Zero tailpipe emissions with green H₂ |

| Compatibility with Existing Fleet | High (drop-in for diesel engines) | Low (requires new hydrogen trucks) |

| Infrastructure Requirement | Minimal new infrastructure | An extensive refuelling network is needed |

| Cost (2026 basis) | Lower relative to hydrogen | Higher due to production & infrastructure |

| Deployment Readiness | Immediate to near term | Mid to long-term (2030+) |

Points to Consider When Selecting a Path

• Fleet readiness: Biofuels fit existing diesel fleets; hydrogen requires new vehicles and refuelling points.

• Carbon priorities: Biofuels deliver immediate emissions reductions today; hydrogen offers deeper cuts long term.

• Policy alignment: RTFO incentives favour renewable fuels now; hydrogen infrastructure plans target later decades.

• Cost factors: Biofuels are more cost-effective in the near term; hydrogen may fall with scale.

Bottom Line

The future of UK long-haul transport lies in a staged approach. Biofuels, especially HVO, are the practical path today. They deliver measurable carbon savings with existing fleets and infrastructure while meeting policy mandates. Hydrogen holds promise for deeper decarbonisation, but it is not yet ready for broad deployment due to infrastructure and cost hurdles. Logistics operators should integrate high-quality biofuels now, while tracking hydrogen developments and planned hydrogen hubs into the 2030s.

FAQs

What defines UK long-haul transport?

Routes over 150 miles, usually served by Class 1 and Class 2 HGVs.

Can HVO be used in any diesel truck?

Yes. Most modern diesel engines can run on HVO without modification.

Is hydrogen fuel widely available for HGVs today?

No. Dedicated hydrogen refuelling infrastructure for HGVs is limited in the UK.

Does the government incentivise alternative fuels?

Yes. RTFO and SAF mandates create incentives for low-carbon fuels.

Will hydrogen replace biofuels in the future?

Potentially in the long term, if the infrastructure and production scale are sufficiently.

Disclaimer

This article is for general information only. All figures, regulations, and fuel performance data are based on publicly available UK government and industry sources.