Table of Contents

Shopify/Amazon Integration has become essential for UK logistics teams managing multi-channel fulfilment in 2025. British retailers now sell through global storefronts while shipping from UK-based warehouses. This creates pressure on warehouse management systems to stay accurate, compliant, and fast. We see this challenge daily across ecommerce, retail, and third-party logistics operations.

The UK ecommerce market reached £177.11 billion in 2024, with cross-border orders driving much of that growth. Amazon UK alone serves over 65 million monthly visitors, while Shopify powers more than 500,000 active UK stores. When systems fail to sync, stock errors rise, orders are delayed, and customer trust drops.

Integration is no longer optional. UK warehouses must connect inventory, orders, VAT data, and shipping rules across platforms in real time. This article explains how Shopify/Amazon Integration works, why it matters for UK compliance, and how to implement it correctly. We focus on warehouse operations, not investor theory, and ground every point in real UK logistics practice.

Why Shopify/Amazon Integration matters for UK warehouse operations

Shopify/Amazon Integration directly affects picking accuracy, dispatch speed, and stock confidence inside UK warehouses. When platforms operate in silos, warehouse teams work blind. Orders arrive late, inventory counts drift, and fulfilment costs increase.

UK consumers expect next-day delivery as standard, especially for Prime-eligible listings. Amazon reports that late shipment rates above 4.0% can trigger account warnings. Shopify stores face similar penalties for poor customer reviews and chargebacks. Integration reduces these risks by synchronising orders instantly.

For UK warehouses, integration also supports volume spikes. Black Friday 2024 drove a 22.4% increase in UK ecommerce orders compared to an average November week. Without unified systems, temporary labour and manual checks fail under pressure. Integrated e-commerce-fulfillment systems scale automatically, handling order surges without adding admin burden or operational risk.

How UK warehouse management systems support multi-channel selling

Core WMS capabilities required in the UK

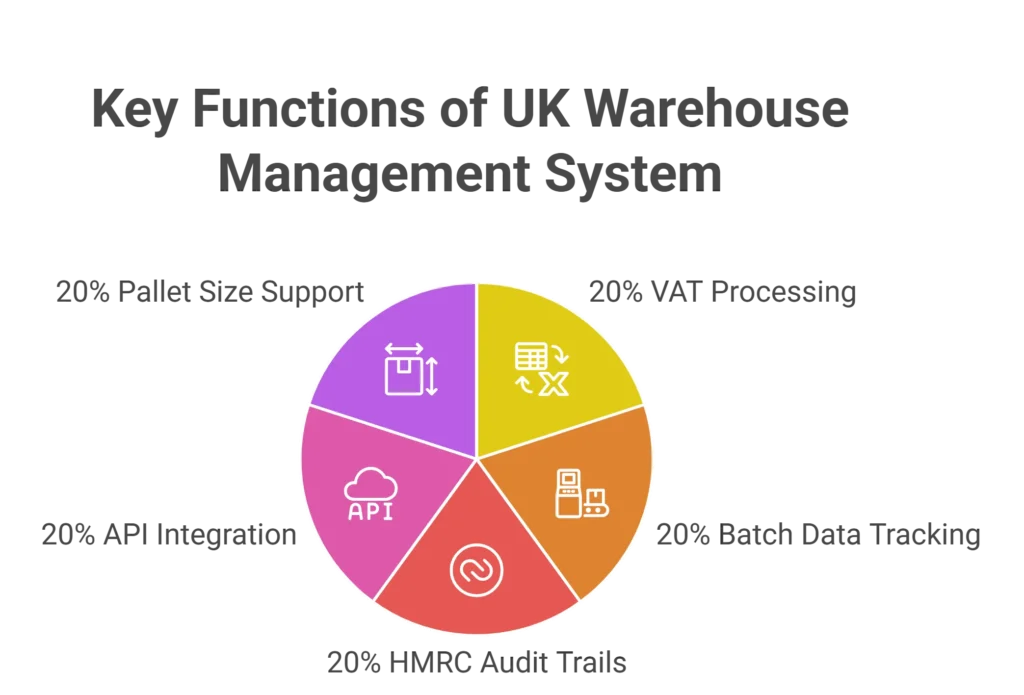

A UK warehouse management system must handle more than stock location. It must process VAT, track batch data, and support HMRC audit trails. Standard UK VAT stands at 20%, and misreporting across platforms creates immediate compliance risk.

Modern WMS platforms integrate APIs from Shopify and Amazon Seller Central. This enables live stock updates, automated order routing, and shipment confirmation within seconds. Without API-level integration, systems rely on CSV uploads that delay fulfilment.

UK warehouses also require support for standard pallet sizes of 1,200 mm by 1,000 mm. Accurate cartonisation data ensures Amazon FBA or Seller Fulfilled Prime requirements are met. A capable WMS handles this automatically.

Order flow between storefronts and warehouses

Shopify/Amazon Integration works by pushing orders into the WMS as soon as checkout completes. The WMS then assigns pick locations, generates labels, and confirms dispatch back to each platform.

Amazon requires shipment confirmation within 24 hours for most seller-fulfilled orders. Shopify customers expect tracking details immediately after dispatch. Integrated workflows meet both requirements without manual input.

This unified order flow also prevents overselling. When one item sells on Amazon, Shopify stock updates instantly. UK warehouses avoid negative stock positions that cause cancellations and penalties. Choosing the right 3PL vs 4PL model ensures seamless stock management and reduces operational errors.

UK compliance considerations when syncing global storefronts

VAT, customs, and reporting accuracy

Shopify/Amazon Integration must respect UK tax law. HMRC requires accurate VAT reporting on every transaction, regardless of sales channel. Incorrect VAT mapping leads to penalties starting at £300 per return.

When selling globally from UK stock, customs data also matters. Shipments leaving the UK require correct commodity codes and country-of-origin data. Integrated systems ensure this data travels with each order.

Amazon collects VAT on certain marketplace transactions, while Shopify merchants often collect VAT directly. Your WMS must differentiate these flows to avoid double reporting. Integration makes this distinction automatic.

Data protection and platform governance

UK logistics systems must follow the UK GDPR, enforced by the Information Commissioner’s Office. Customer data transferred between Shopify, Amazon, and WMS platforms must remain secure.

Integrated systems use encrypted API connections rather than manual exports. This reduces exposure to data breaches and unauthorised access. Amazon requires adherence to its Data Protection Policy for all sellers.

Shopify also enforces strict app permissions. Only approved integrations can access order and customer data. UK warehouses should audit these connections quarterly.

Technology options for Shopify/Amazon Integration in the UK

Middleware platforms versus native integrations

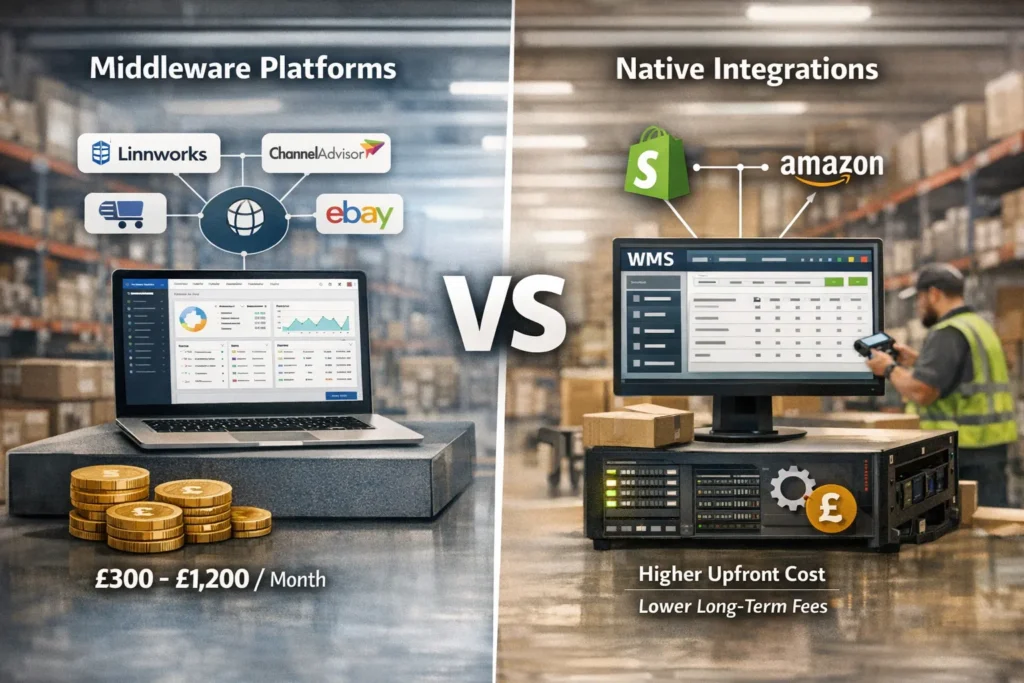

UK warehouses typically choose between middleware platforms and native WMS integrations. Middleware tools like Linnworks or ChannelAdvisor act as central hubs. They manage stock, orders, and listings across channels.

Native integrations connect Shopify and Amazon directly to the WMS. This reduces system layers but requires a stronger technical setup. Native options suit high-volume warehouses with dedicated IT teams.

Middleware platforms often cost between £300 and £1,200 per month in the UK, depending on order volume. Native integrations carry higher upfront costs but lower long-term fees.

Shipping and carrier integration impact

Shopify/Amazon Integration works best when carriers are included. UK warehouses rely heavily on Royal Mail, DPD, and Evri. Integrated systems auto-select services based on destination and SLA.

Royal Mail handles over 11.5 billion letters and parcels annually, making it critical for domestic fulfilment. Amazon requires valid carrier tracking IDs for performance metrics. Integration ensures compliance.

Carrier integration also supports international shipping rules. Customs labels and commercial invoices are generated automatically. This reduces delays at borders.

Case Study: UK fashion retailer scaling global sales

A Manchester-based fashion retailer operating a 12,000 sq ft warehouse implemented Shopify/Amazon Integration in March 2024. Before integration, the business managed stock manually across platforms. Order errors averaged 6.2% monthly.

After connecting Shopify, Amazon UK, and their WMS through middleware, stock is synchronised every 60 seconds. Order accuracy improved to 99.4% within eight weeks. Dispatch times fell from 36 hours to 14 hours.

The retailer expanded sales to Germany and France without adding warehouse staff. VAT data flowed correctly into HMRC reports. Customer complaints dropped by 41% by Q3 2024.

Key benefits of Shopify/Amazon Integration for UK warehouses

Operational improvements include:

- Real-time inventory accuracy across platforms.

- Faster picking, packing, and dispatch workflows.

- Reduced order cancellations and late shipment rates.

- Improved compliance with Amazon performance metrics.

Commercial advantages include:

- Lower labour costs through automation.

- Higher customer satisfaction scores.

- Easier expansion into international markets.

- Better data visibility for planning and forecasting.

Integration comparison table

| Integration Element | Without Integration | With Integration |

|---|---|---|

| Inventory updates | Manual, delayed | Real-time, automated |

| Order accuracy | Error-prone | Above 99% achievable |

| VAT handling | Manual checks | Automated mapping |

| Dispatch speed | 24–48 hours | Same-day achievable |

| Compliance risk | High | Significantly reduced |

This table shows how integration directly improves measurable warehouse outcomes.

Bottom Line

Shopify/Amazon Integration is now a core requirement for UK warehouse management in 2025. It aligns inventory, orders, compliance, and customer expectations into a single operational framework. Without integration, UK warehouses face rising costs, compliance exposure, and service failures.

We recommend starting with a system audit. Confirm API compatibility, VAT handling, and carrier support. Choose middleware or native integration based on volume and technical capacity. Test integrations during low-volume periods to reduce risk.

FAQs

What is Shopify/Amazon Integration?

It connects Shopify and Amazon sales channels with warehouse systems for real-time order and inventory management.

Is integration required for UK VAT compliance?

Integration is not mandatory, but it significantly reduces VAT reporting errors and compliance risk.

Can small UK warehouses use integration tools?

Yes. Many middleware platforms support low-order volumes with scalable pricing.

Does integration support international shipping from the UK?

Yes. Integrated systems manage customs data and carrier rules automatically.

How long does implementation take in the UK?

Most integrations are complete within 2 to 6 weeks, depending on system complexity.

Disclaimer

This article is for general informational purposes only and does not constitute legal, tax, or regulatory advice for UK logistics operations.