Table of Contents

E-commerce Fulfillment in the UK is the backbone of online retail success in 2025. The UK digital economy now accounts for 26.8% of total retail sales and remains Europe’s most advanced market. We define e-commerce fulfillment as the complete process of receiving, storing, picking, packing, and shipping online orders to consumers. With UK ecommerce revenue reaching USD 127 billion in 2024, logistics precision is now non-negotiable.

Consumer expectations are rising sharply. Data from the 2025 DHL E-Commerce Trends Report shows that 80% of UK shoppers abandon carts if preferred delivery options are missing. That emphasises how fulfillment directly affects conversions. Most UK online retailers now must align their fulfilment strategies with consumer demand for speed, transparency, and flexibility.

Effective fulfillment is not just about moving products; it’s about crafting a smooth, reliable customer experience that meets modern expectations. Delivering on this requires data-driven choices about partners, technology, and cost modelling.

Understanding fulfillment costs, regulations, and automation is essential for UK businesses that want to compete and scale. Therefore, we will break down the key components of UK e-commerce fulfilment and what they mean for your operations.

UK E-commerce Fulfillment Market Overview

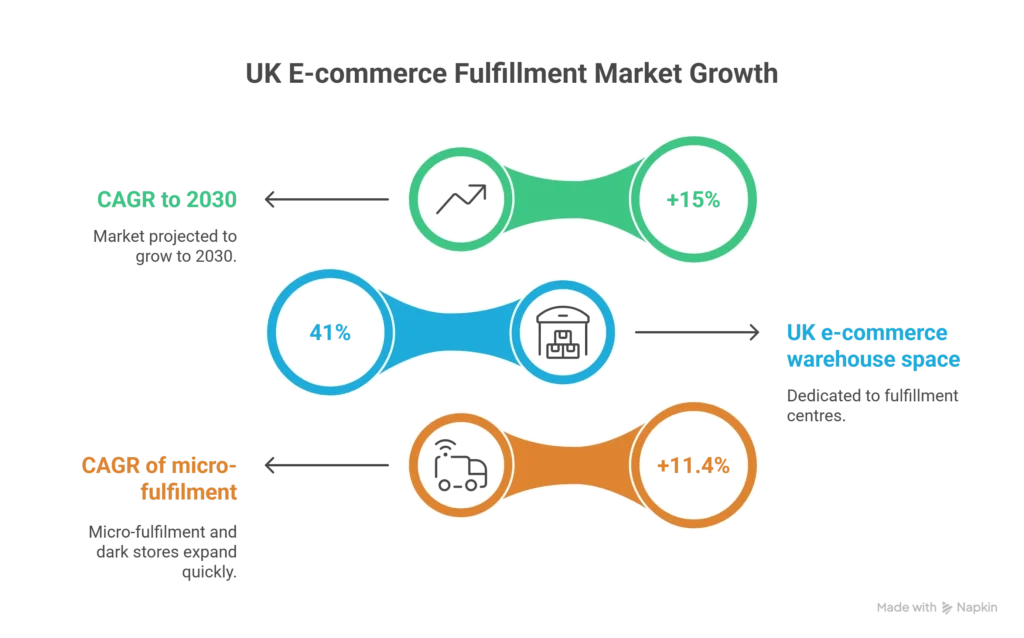

Effective E-commerce Fulfillment in the UK hinges on a strong logistics ecosystem supported by data and investment. The UK e-commerce fulfillment services market generated USD 7,545.2 million in 2024 and is projected to grow at a 15% CAGR to 2030. This growth reflects retailers and fulfilment providers scaling capacity to meet online demand. Storage and shipping services remain the largest revenue drivers, but bundled and value-added fulfilment services are rapidly gaining share.

Warehouse configuration is also evolving. About 41% of UK e-commerce warehouse space is dedicated to fulfillment centres, while micro-fulfilment and dark stores expand quickly with 11.4% CAGR. These trends indicate that UK fulfilment is diversifying. Urban micro-fulfilment hubs reduce delivery distances and cut transport times.

Regulatory context: Post-Brexit, UK logistics must navigate VAT and customs rules affecting cross-border fulfillment operations. While streamlined deals with the EU aim to reduce friction, paperwork, and VAT compliance challenges remain. Fulfilment teams must integrate customs handling into their workflows to avoid delays and unexpected costs.

Cost Components of E-commerce Fulfillment

Understanding cost structures in E-commerce Fulfillment is essential for profitable operations. UK fulfilment pricing includes several distinct elements.

Below is a typical cost breakdown used by many UK fulfilment partners in 2025 (GBP):

| Cost Type | Typical Range per Unit | Notes |

|---|---|---|

| Receiving Fees | £0–£30 per pallet | May be free up to thresholds. |

| Storage Fees | £5–£30 per pallet/week | Higher during Q4 peak season. |

| Pick & Pack | £0.75–£3+ per order | Multi-item orders increase cost. |

| Packaging | £0.10–£1 | Depends on branding. |

| Shipping | £2.50–£15+ | Courier, weight, zone dependent. |

| Returns Handling | £1–£5 | Additional for inspection. |

Storage fees remain a significant factor. In peak seasons like Black Friday and Christmas, rates skew higher due to limited space and increased demand. Fulfilment centres often charge £10–£30 per pallet per month. Similarly, pick and pack fees escalate with item complexity, so SKUs with multiple pieces cost more to fulfil.

Shipping cost variability also matters. Standard UK delivery ranges from £2.50 to £5, while next-day options may cost £8–£15 or more. Delivery choice affects cart conversion and customer satisfaction, as highlighted by the DHL study showing fulfilment options influence 80% of cart decisions.

Warehouse Automation and Technology Trends

E-commerce Fulfillment in the UK is rapidly embracing automation. Over 50% of UK fulfilment centres were expected to utilise AI by 2025, with projections showing over 85% automation by 2030. This shift is driven by labour shortages, rising delivery volumes, and the need for error-free operations.

Automation impacts key fulfilment functions such as picking, sorting, and inventory tracking. Robotics and AI improve uptime and throughput while reducing labour costs. UK warehouses will already see hundreds of thousands of service robots deployed by 2025. This technology helps companies handle peak volumes without compromising speed or accuracy.

Integration with Warehouse Management Systems (WMS) is essential. Modern WMS platforms offer real-time visibility, automated replenishment triggers, and predictive analytics that mitigate stockouts. These systems also support regulatory compliance, capturing data needed for VAT and customs audits.

Delivery Speed and Customer Expectations

In the UK, delivery speed significantly impacts customer satisfaction. Recent research shows standard delivery options command a 52.4% share of the UK e-commerce logistics market, but demand for faster services is rising. Same-day and next-day delivery services are expanding at nearly 9.6% CAGR through 2030.

Innovations in delivery models are reshaping fulfilment expectations. For example, InPost and ASOS launched a next-day out-of-home delivery service across a 12,800 parcel locker network. These lockers cut last-mile delivery friction and reduce failed delivery attempts.

Consumer survey data confirms this shift: 53% of UK shoppers expect social commerce shopping experiences and faster logistics integrated with mobile apps and messaging. Retailers must now offer multiple delivery tiers and real-time tracking to retain customers.

Regulatory and Risk Considerations

Managing logistics compliance is critical for UK E-commerce Fulfillment, particularly post-Brexit. VAT and customs requirements apply to cross-border fulfilment. UK import duties often use CIF (Cost, Insurance, and Freight) valuation, impacting landed cost calculations.

Cybersecurity risk is another pressing issue. In 2025, reported cyberattacks targeting UK retail and logistics systems surged, disrupting inventory systems and inflating costs by 15–25% for affected firms. Logistics providers must secure Warehouse Management and Order Management systems to protect against interruptions. Learn more in our article on logistics.

Case Study: ASOS and InPost Partnership

In 2025, ASOS partnered with InPost to launch a next-day out-of-home delivery service across 12,800 lockers nationwide. This initiative significantly reduced last-mile delivery costs and increased customer pick-up convenience.

The partnership expanded InPost’s market share to roughly 8% of the UK parcel delivery market, accelerated by its acquisition of Yodel. By integrating parcel lockers with online checkout options, ASOS improved delivery success rates and reduced failed delivery attempts.

Bottom Line

E-commerce Fulfillment in the UK now demands a strategic blend of cost control, technology investment, and customer-centric delivery options. Businesses must balance storage and shipping costs, compliance with VAT and customs requirements, and rising consumer expectations for speed and sustainability. Automation and AI are essential to meet demand efficiently and competitively. Final success hinges on selecting fulfilment partners who offer transparency, flexibility, and secure, scalable technology.

FAQs

What is E-commerce Fulfillment?

The process of receiving, storing, picking, packing, and delivering online orders to customers.

How much does fulfilment cost in the UK?

Typical costs range from £5 to £30 per pallet per week for storage and £2.50 to £15+ per shipment.

Do UK fulfilment centres handle returns?

Yes, most centres offer returns handling, often charging £1.50–£5 per item.

Is automation important for fulfilment?

Yes, over 50% of UK fulfilment centres use AI, rising to 85% by 2030.

How does Brexit affect fulfilment?

Brexit adds VAT and customs compliance steps for EU cross-border orders, requiring careful handling.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or operational logistics advice.