Investing in Portugal’s Golden Visa program opens a gateway to Europe for non-EU investors, offering not just a potential return on investment but also a wealth of lifestyle and mobility advantages. From the sun-kissed beaches of the Algarve to the historic streets of Lisbon, the program provides a unique opportunity to diversify your portfolio while enjoying the benefits of residency in a European nation. Whether you’re looking for a new home, a retirement destination, or simply an investment opportunity with added perks, Portugal’s Golden Visa could be the perfect fit. Keep reading to learn more about what makes this program a wise financial move.

Understanding Portugal’s Golden Visa Program: Benefits and Eligibility

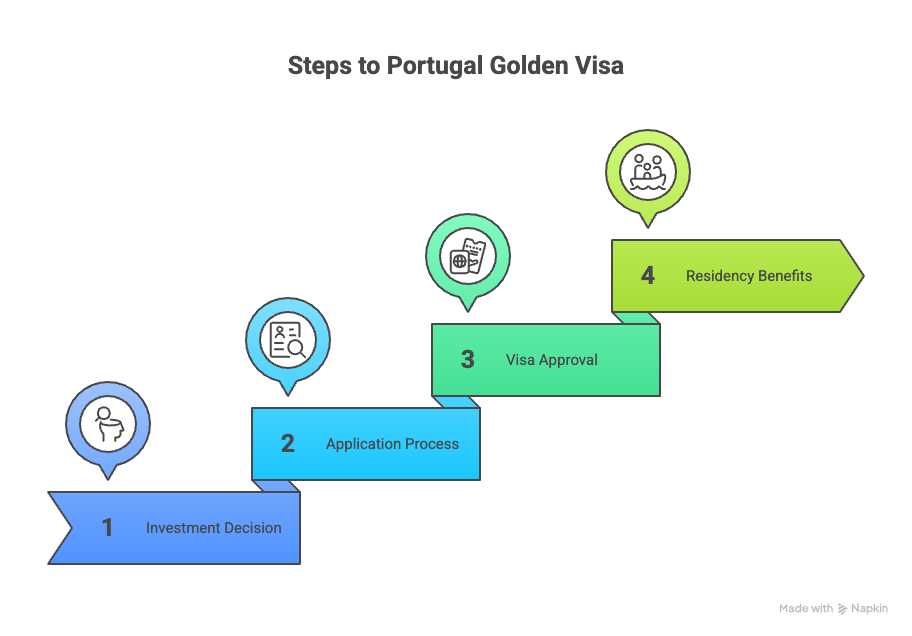

The Portugal Golden Visa program is a residency-by-investment scheme that has been attracting non-EU citizens since its inception in 2012. By making a qualifying investment in the country, such as purchasing real estate or investing in a business, investors can obtain a temporary residence permit. This residence permit grants holders the right to live, work, and study in Portugal, with the option to apply for permanent residency and citizenship after five years.

Beyond the fundamental right of residency, the program offers several enticing benefits. The threshold for investment can vary, allowing for flexibility depending on the investor’s interests and capabilities. Additionally, the Golden Visa requires holders to spend only a minimum of seven days in Portugal during the first year, and 14 days in subsequent two-year periods, which is advantageous for those not wishing to relocate permanently.

Eligibility for the Portugal golden visa is fairly broad, extending to non-EU/EEA/Swiss citizens who undertake one of the various qualifying investments. These investments can range from real estate purchases to capital transfers, job creation, or contributions to the arts. As such, interested applicants should work with legal professionals to determine the best investment path for their needs and to ensure compliance with all program requirements.

Fulfilling these conditions opens the door to a European lifestyle, free movement within the Schengen Area, and a host of social services in Portugal. As an added bonus, the Portuguese tax regime offers favorable conditions, such as the Non-Habitual Resident program, which can result in reduced tax rates on certain types of income for qualifying individuals.

Diversifying Your Investment Portfolio with Portugal’s Real Estate Market

One of the most popular routes to obtaining the Golden Visa in Portugal is through investment in real estate. Portugal’s property market offers a promising outlook, with steady appreciation observed in recent years. This resilience, coupled with the nation’s strong tourism sector, presents a compelling argument for investors looking to expand their portfolio into European property.

Potential investors can find opportunities across the country, from the vibrant capital of Lisbon and the culture-rich Porto, to the serene Algarve region known for its stunning coastline. Each location offers unique advantages, whether it’s Lisbon’s property appreciation potential or the Algarve’s appeal as a holiday rental market. The real estate route is not only a tangible asset but can also generate rental income while providing a personal holiday destination.

Adopting a strategic approach when investing in Portuguese property ensures maximization of the Golden Visa benefits. Tax laws in Portugal, including exemptions and deductions, can significantly affect potential earnings from real estate investments. Professional guidance is advised to navigate these intricacies effectively, ensuring compliance and optimizing the property’s return on investment.

Exploring the Long-Term Financial Benefits of Portugal’s Golden Visa

When contemplating the financial implications of Portugal’s Golden Visa, it’s essential to recognize the program’s long-term benefits. A significant advantage is the potential for capital gains through investment in the fast-growing Portuguese real estate market. Over time, these investments can appreciate, yielding substantial returns when the properties are eventually sold.

Moreover, the aforementioned Non-Habitual Resident (NHR) tax regime in Portugal offers reduced tax rates for the first ten years of residency. This can result in significant tax savings for high-value individuals, particularly those with large pensions, dividends, or royalties from overseas. Coupling the Golden Visa with the NHR status maximizes fiscal advantages for savvy investors.

Another aspect to consider is estate planning and wealth transfer. Portugal’s favorable inheritance laws and no wealth tax on worldwide assets for non-habitual residents create an appealing environment for legacy planning. This ensures that the benefits of the investment extend beyond the immediate returns and positively impact future generations.

Portugal’s Golden Visa program represents a comprehensive investment opportunity that extends far beyond the financial aspects. It offers individuals and families the chance to invest in their futures, securing not just a luxurious lifestyle but also stability, global freedom, and a sense of community in one of Europe’s most welcoming countries.