Table of Contents

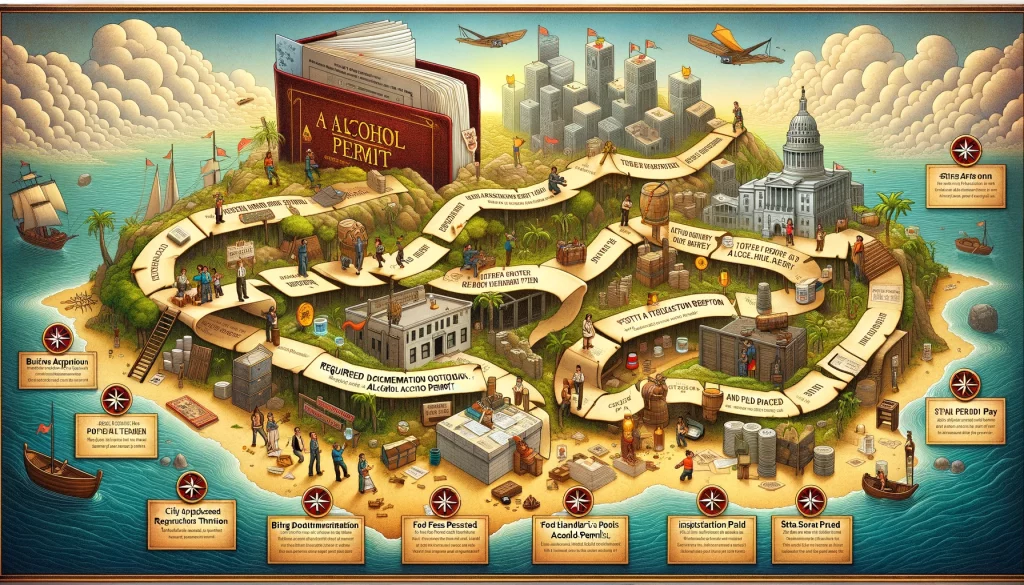

Obtaining a liquor license can feel like an uphill battle. The process requires extensive paperwork and a thorough understanding of state and local alcohol laws.

Depending on the type of establishment, you may need to prepare a building title, photos, food handler’s permit, and floor plan drawing. You also need to pay state and city fees.

Applying for a Liquor License

How to get an alcohol permit in Dallas, TX? You will need a license if your business plans to sell wine, beer, or liquor. Whether buying an existing license or starting from scratch, the process can be lengthy and confusing. It is recommended to work with an attorney who understands Alcoholic Beverage Control, or ABC, law and your local requirements.

Most states have a quota system that limits the number of new licenses each municipality can issue. It can increase the cost of a license and can lead to wait times.

In addition, there are different types of liquor and beer licenses. For example, wholesale licenses allow manufacturers and warehouses to sell products to retailers who resell them to consumers. Retail licenses typically include restaurants and other establishments that serve alcohol to customers on the premises. Other licenses include drug and grocery store beer sold for off-premise consumption. It is essential to select the correct type of license for your business.

Getting a Local Government Opinion

If you’re applying for a permit to transport your beer, it’s essential to understand that alcohol transportation is regulated state-by-state. It means you’ll need to acquire a transporting permit from the state where you intend to sell your beer. It will likely require a background check, a financial audit, and consultations with local businesses and citizens in the target area.

Over 30 permits are issued by the Liquor Authority, with their terms and fees varying wildly by permit type and local government. For example, an MB permit authorizes establishments to sell beer for consumption on premises, while a Q permit authorizes retailers to sell wine that can be consumed off-site. Other permits include a bottling permit, which allows a licensed wholesaler to conduct bottling, recasting, and filtering operations, and a fleet trucking permit that authorizes a licensed transporter to register multiple vehicles under a single permit.

Submitting Your Application

You must obtain a license if you’re looking to operate a bar, restaurant, club, or music venue. The license type depends on the business type and specific alcohol sales laws specified by the state. You must also satisfy citizenship requirements. It includes being a citizen of the United States or a permanent resident alien. You must submit personal identification forms, fingerprint forms, and a certificate of limited liability.

Depending on the type of license you want, you’ll need to publish an application in the newspaper where your property is located. In addition, you must notify all churches, hospitals, and schools within 500 feet of the premises.

Alcohol transportation is primarily regulated on a state-by-state basis. To transport alcoholic beverages, you must have an alcohol transport permit. You can obtain one through the Liquor Authority. The permit allows you to transport alcoholic beverages from out-of-state suppliers or manufacturers.

Getting Approved

The United States’ history with alcohol has a long, tumultuous, and sometimes violent past. It wasn’t until 1933 that prohibition ended, and state governments began regulating the selling and serving of alcoholic beverages, with each territory following its laws and licensing stipulations.

Beginning at the local level, each municipality has its process for reviewing applicants. It includes conducting background checks, financial audits, and consulting with businesses and residents near your establishment to determine if they feel you’re a suitable candidate for an alcohol permit. You may also be required to publish an advertisement and notify churches, hospitals, schools, and other residences within a 500-foot radius of your location.

Your new business can begin operating once approved for a license. Remember that license fees are a significant expense, so budget accordingly. Also, remember to set up a merchant account to accept customer credit card payments.