Table of Contents

Reverse Logistics has become a core operational priority for UK e-commerce businesses in 2026. Online returns are no longer an exception. They are an expected part of the customer journey. According to UK retail logistics benchmarks, online return rates sit between 20% and 30%, rising above 40% in fashion. These volumes place direct pressure on warehousing, transport, labour, and compliance costs. Reverse Logistics now determines profit protection, customer loyalty, and regulatory compliance.

In the UK market, returns are shaped by strict consumer law, high delivery expectations, and sustainability targets. The Consumer Contracts Regulations give customers 14 days to return most online purchases. Within e-commerce-fulfilment operations, logistics providers also face higher fuel costs, labour shortages, and net-zero reporting requirements. Reverse Logistics must therefore be structured, data-driven, and cost-controlled from day one.

This article explains how Reverse Logistics works in the UK, why it matters in 2026, and which best practices actually reduce costs. We focus on operational steps, compliance requirements, technology, and measurable outcomes.

Why Reverse Logistics matters in the UK e-commerce economy

Reverse Logistics directly affects margins in the UK’s £130 billion e-commerce sector. Every returned parcel triggers decisions regarding transport, handling, inspection, and resale. Industry data shows that processing a single return costs UK retailers between £8.50 and £15.60, excluding lost revenue. These costs escalate quickly without clear processes.

Returns also influence customer behaviour. Research cited by DHL shows that 79% of UK shoppers expect free and simple returns. When returns fail, repeat purchase rates drop sharply. Reverse Logistics, therefore, acts as both a cost centre and a loyalty driver. UK operators must strike a balance between speed and control to protect their margins.

From a regulatory perspective, Reverse Logistics also affects waste compliance. Returned goods that cannot be resold fall under the UK Waste Framework Directive. Incorrect disposal can lead to enforcement action and fines. Effective Reverse Logistics reduces waste, improves recovery value, and supports sustainability reporting, while also integrating seamlessly with Last-Mile Delivery in London to ensure efficient returns handling and environmentally responsible operations.

UK regulations shaping Reverse Logistics operations

Consumer rights and return obligations

UK Reverse Logistics processes must align with consumer protection law. The Consumer Contracts Regulations require retailers to refund customers within 14 days of receiving returned goods. This timeline forces fast inbound processing and accurate inventory visibility. Delays increase dispute rates and chargebacks.

Retailers may deduct value for damaged goods, but only if policies are clear and documented. Reverse Logistics teams must therefore record condition data at receipt. Without evidence, refund disputes often favour the consumer. This legal framework makes structured inspection workflows essential.

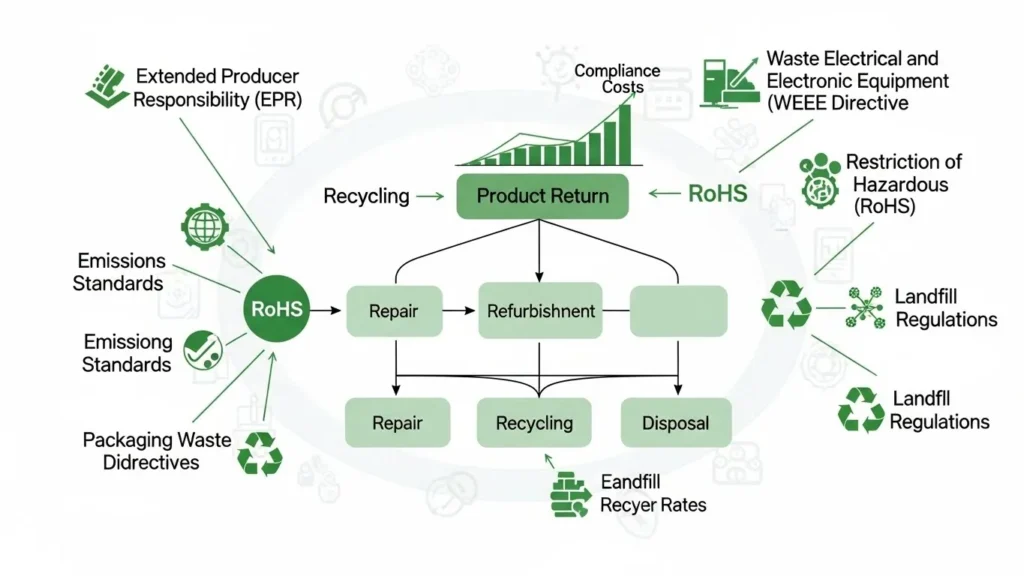

Environmental and waste compliance

Environmental regulation now plays a larger role in Reverse Logistics decisions. The UK’s Extended Producer Responsibility rules require accurate reporting on unsold and returned goods. Products sent to landfill carry higher financial and reputational risk.

Returned electrical goods fall under WEEE regulations. Textiles increasingly attract scrutiny due to waste volumes. Reverse Logistics strategies that prioritise resale, refurbishment, or recycling reduce regulatory exposure. Operators that track recovery rates gain stronger ESG reporting credibility. Compliance is no longer optional.

Best practice: Designing efficient return flows

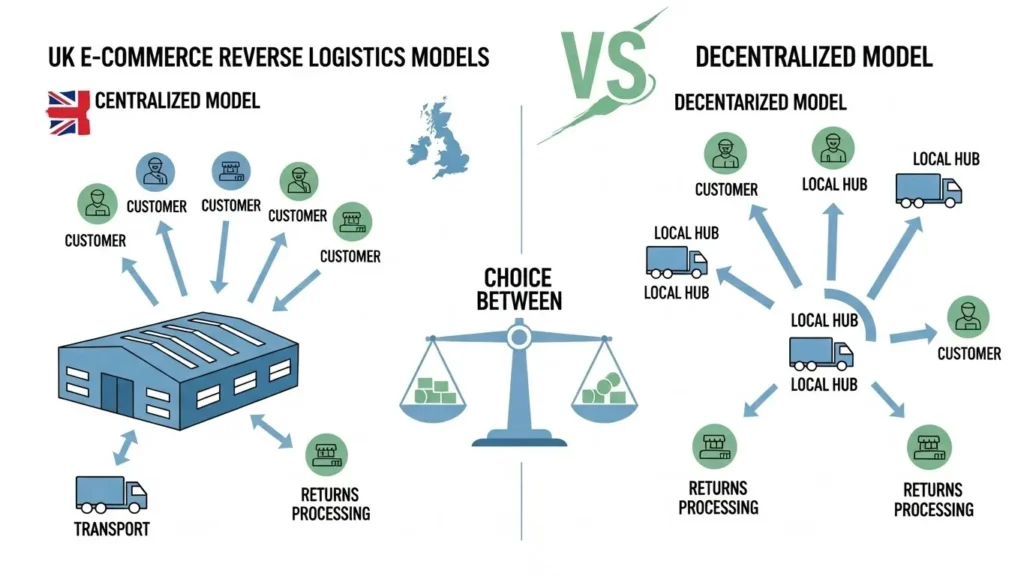

Centralised versus decentralised returns

UK e-commerce businesses typically choose between centralised and decentralised Reverse Logistics models. Centralised returns hubs lower inspection costs and improve consistency. However, they increase transport miles and inbound congestion. Decentralised models shorten transport distances but raise labour duplication.

Data from large UK fulfilment networks shows that hybrid models perform best. High-value goods move to central hubs, while low-value items are processed regionally. This approach cuts handling costs by up to 18% while maintaining control and works seamlessly with Shopify/Amazon Integration to streamline order management across multiple sales channels.

Standardised inspection and grading

Reverse Logistics fails when inspection criteria vary by site or operator. UK best practice uses standard grading categories such as new, resale, refurbish, recycle, or dispose. Each grade links to a predefined system action.

Barcode scanning, photo capture, and condition codes reduce disputes and speed decisions. Leading UK operators process standard returns within 48 hours of receipt. Faster grading shortens refund cycles and improves customer satisfaction.

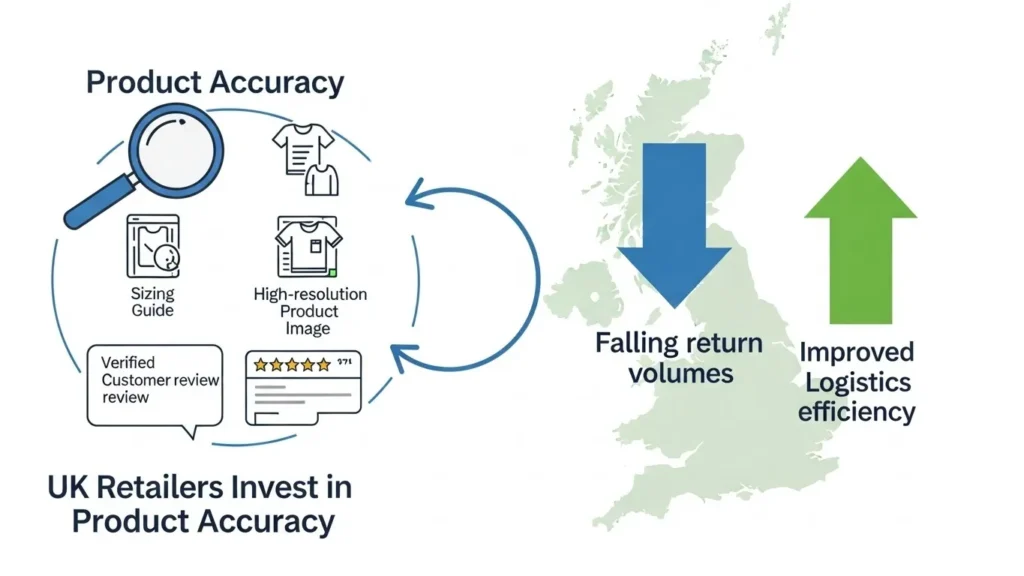

Best practice: Reducing return volumes at source

Reverse Logistics efficiency improves dramatically when return volumes fall. UK retailers that invest in product accuracy see measurable gains. Clear sizing guides, high-resolution images, and verified customer reviews reduce preventable returns.

Data from NetSuite highlights that incorrect product descriptions account for over 23% of e-commerce returns. Fixing content issues is cheaper than processing returns. Reverse Logistics teams should share return reason data with merchandising teams weekly.

Another proven tactic is return friction. Offering free returns while charging for home collection reduces volumes without hurting conversion. UK case data shows a 12% reduction in return rates when collection fees apply.

Best practice: Technology enabling Reverse Logistics

Warehouse management and visibility

Modern Reverse Logistics depends on system integration. UK operators rely on WMS platforms that support reverse flows, not just outbound picking. Returned inventory must update stock availability in real time.

Without integration, resale windows are missed. Apparel resale value drops by up to 50% after 30 days. Real-time visibility allows rapid relisting and redeployment.

Data analytics and forecasting

Advanced UK logistics providers use return data for forecasting. Patterns by SKU, region, and carrier highlight root causes. Predictive models help adjust inventory placement and delivery methods.

Analytics also support fraud detection. Serial returners and damaged-item claims can be flagged automatically. This reduces abuse while protecting genuine customers.

Cost drivers and optimisation opportunities

Reverse Logistics costs in the UK break down into transport, labour, space, and write-offs. Transport remains the highest variable cost. Consolidated collections and carrier negotiations reduce per-unit costs.

Labour efficiency improves through automation. Automated sortation and AI-based grading cut manual handling time by up to 35%. Space optimisation matters too. Returns clog prime pick faces when unmanaged. Dedicated reverse zones improve throughput.

The table below summarises key cost drivers and optimisation levers.

| Cost Area | Typical UK Impact | Optimisation Lever |

|---|---|---|

| Transport | £3.20–£6.80 per return | Consolidated collections |

| Labour | 5–12% of return value | Standardised grading |

| Storage | High during peak seasons | Dedicated reverse zones |

| Write-offs | 5–12% of returns value | Faster resale decisions |

Real UK case study: ASOS returns optimisation

SOS provides a real UK example of Reverse Logistics optimisation through its partnership with DHL eCommerce. Facing online return rates as high as 40 % in fast fashion, ASOS adopted a streamlined returns workflow using DHL’s Parcel Connect service.

Returns are issued with a single pre-printed label that directs unwanted goods back into ASOS’s returns network via over 140,000 DHL Access Points, simplifying the customer experience and standardising inbound flows. Returned items are routed efficiently back to regional return centres for sorting and disposition, reducing transit handling and lowering overall reverse logistics costs.

This solution improves inventory velocity by keeping returned stock moving back into resale channels faster, mitigating depreciation and lowering write-offs.

Sustainability and Reverse Logistics alignment

Reverse Logistics plays a direct role in UK sustainability targets. Returned goods represent a major waste stream. Landfill disposal damages brand reputation and increases regulatory exposure.

Leading UK operators prioritise resale, donation, and recycling. Some integrate secondary marketplaces directly into return workflows. Each recovered unit reduces carbon impact and write-offs.

Repsol’s logistics sustainability research shows that optimised Reverse Logistics can cut transport emissions by up to 15% through route consolidation. These gains matter as UK firms face stricter ESG reporting.

Key operational takeaways

- Treat Reverse Logistics as a core supply chain function, not an afterthought.

- Design return flows around product value and resale speed.

- Align processes with UK consumer and waste regulations.

- Use technology to drive visibility and faster decisions.

- Share return data across merchandising, fulfilment, and customer service teams.

These actions consistently deliver measurable improvements in UK e-commerce operations.

Bottom Line

Reverse Logistics now defines success for UK e-commerce operations in 2026. High return volumes, strict consumer law, and rising costs leave no room for informal processes. Businesses that structure Reverse Logistics around speed, data, and compliance protect both margins and customer trust.

The most effective UK operators reduce return volumes at source, process inbound goods within 48 hours, and maximise resale value. Technology, standardisation, and clear policies turn returns into a controlled flow rather than a financial drain.

FAQs

What is Reverse Logistics in e-commerce?

Reverse Logistics manages the return, inspection, and recovery of goods from customers back to sellers.

Why is Reverse Logistics costly in the UK?

High labour costs, transport charges, and strict refund timelines increase operational expenses.

How fast must UK retailers process returns?

Refunds must be issued within 14 days of receiving returned goods.

Can Reverse Logistics support sustainability goals?

Yes. Resale, refurbishment, and recycling reduce waste and emissions.

Which sectors face the highest return rates?

Fashion and footwear experience the highest UK return volumes.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or operational advice for logistics businesses.