Table of Contents

Post-Brexit Customs rules still shape how UK businesses import goods from the EU as of December 23, 2025. Every company moving goods into Great Britain must complete full customs declarations and pay all relevant tariffs at the time of import. These obligations apply regardless of whether the goods are coming from the EU or any other trading partner.

Since the UK left the EU’s Customs Union, the Trade and Cooperation Agreement (TCA) enables preferential tariff treatment, but only if proof of origin is provided and accurately stated on declarations.

In 2025, the UK also implemented safety and security declaration requirements for EU imports to align documentary requirements with global trade partners. These rules directly impact International Freight Forwarding, as declarations must now be lodged before goods reach the UK border, increasing planning and data accuracy requirements.

These changes significantly affect supply chain planning, border clearance costs, and regulatory workload for importers operating through International Freight Forwarding networks. This checklist gives UK logistics teams the precise steps and data needed to stay compliant and optimise customs processes as we approach 2026.

1. Register for the Right Identifiers

Economic Operator Registration and Identification (EORI)

Every UK importer must hold a valid UK-issued EORI number beginning with “GB”. This is mandatory before submitting any customs declaration.

Without an EORI:

- HMRC will not process your import declarations.

- Goods will be held at the border.

- Delays can disrupt supply schedules.

Action point: Apply for a GB EORI if you don’t already have one.

VAT Registration

Importers may also need UK VAT registration. This depends on whether goods are stored, sold, or delivered to consumers in the UK.

Data flash: In the UK 2025 Border Strategy, import VAT revenues totalled £32.8 billion, while customs duty brought in £3.4 billion, showing how critical tax compliance is for border processes.

2. Prepare Accurate Commodity Codes and Valuation

Find the Correct Commodity Code

Commodity codes determine how much duty and VAT are due. Incorrect codes lead to under- or over-payment and potential penalties.

Data tip: Some product sectors have high duty rates (e.g., certain textiles or electronics). Always verify codes via the UK Trade Tariff database.

Value Your Shipment Correctly

The customs value used for duty and VAT calculations must include:

- Purchase price

- Transport costs

- Insurance up to the UK entry point

This ensures correct duty liability from Day 1. Correct valuation and coding reduce hold-ups at ports like Dover, which handles 383 million tonnes of freight annually.

3. Understand Tariff and Duty Rules

Preferential Tariff under the TCA

Under the Trade and Cooperation Agreement, UK importers can pay 0% customs duty on many goods from the EU if they prove origin. This requires:

- A statement on origin from the exporter,

- Or a reliable importer’s knowledge and records.

Without proof:

- Standard duty applies.

- Costs rise, and profitability falls.

Low-Value Imports

As of 2025, the UK government announced that the low-value import duty relief (below £135) will be phased out by March 2029. This will increase duty obligations on small parcels, driven by rapid parcel growth from China and elsewhere.

Logistics teams must plan duty for all consignments irrespective of value.

4. Comply with Safety, Security and SPS Requirements

Safety & Security Declarations

From late 2024 onwards, Post-Brexit Customs requires safety and security declarations for all EU imports.

These declarations must be submitted before goods reach the UK border. Lacking them delays releases and incurs penalties.

SPS Rules for Agri-Food and Plants

Pre-notifications are required for:

- Animal products

- High-risk foods

- Plants and plant products

These pre-notifications enter via systems such as IPAFFS (Import of Products, Animals, Food and Feed System).

Medium-risk goods may face identity checks at Border Control Posts, and some physical checks are being phased in through 2027.

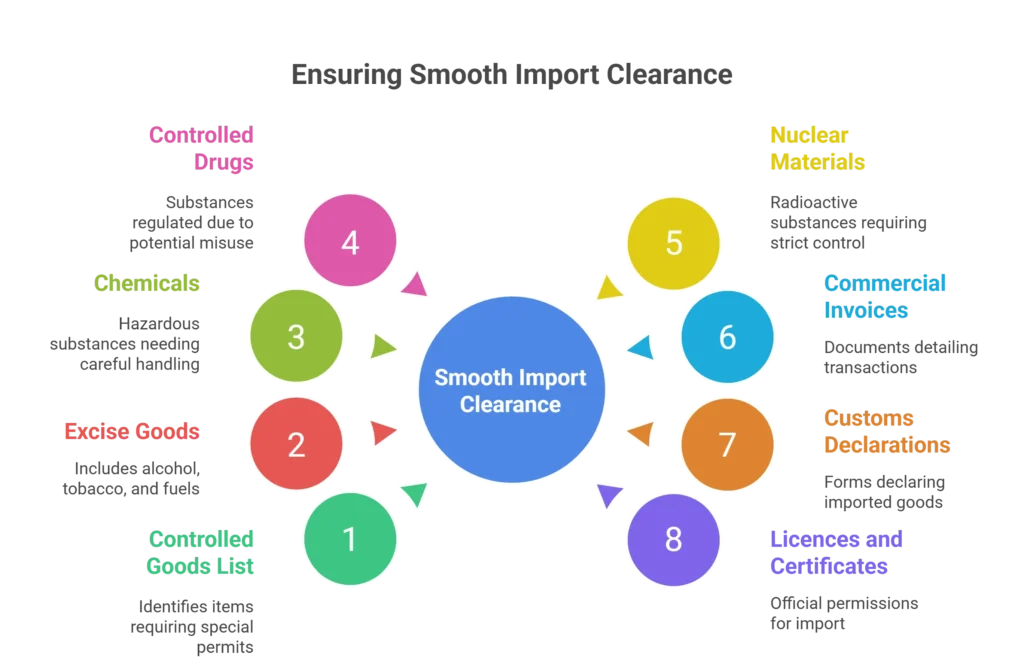

5. Licences and Controlled Goods

Check Controlled Goods List

Some imports need licences or special permits, including:

- Excise goods (alcohol, tobacco, fuels),

- Chemicals and hazardous substances,

- Controlled drugs,

- Nuclear materials.

Failing to obtain the right licence stops clearance.

Record Keeping

Importers must retain all:

- Commercial invoices,

- Customs declarations,

- Licences and certificates.

These are essential for audits and tariff preference claims. Detailed records help avoid costly HMRC challenges.

6. Choose Your Customs Handling Strategy

Use a Customs Agent or Freight Forwarder

Most UK importers outsource declaration handling to experts. A customs agent:

- Files entries on your behalf,

- Advises on origin proofs,

- Manages duty optimisation.

Simplified Declarations

Frequent importers can apply for simplified procedures and duty deferments via HMRC’s Customs Declaration Service (CDS).

This improves cash flow and reduces clerical load but needs prior approval.

7. Monitor Regulatory Changes

SPS Agreement Negotiations

In May 2025, the UK and EU agreed to progress a UK-EU SPS Area to ease border checks on most agrifood products. Final details are pending.

Action point: Stay updated, new agreements could remove paperwork for major import categories.

Future Border Digital Services

Plans for a Single Trade Window may streamline submissions across customs, SPS, licensing, and safety checks. Implementation timelines remain under review for 2026-27.

Case Study: UK Wholesaler Navigates Rising Border Costs in 2025

In 2025, a UK fresh produce wholesaler importing vegetables from the Netherlands faced new SPS pre-notification requirements and documentary checks. Without early IPAFFS filings, goods were held at Dover for 24 hours, costing an extra £4,000 in storage and spoilage. After investing in specialist customs software and training, the company cut its average border clearance time to 4 hours, sustaining margins and improving supplier reliability. This real-world example shows how Post-Brexit Customs compliance directly affects operational performance.

Checklist Table: Essential Post-Brexit Customs Steps for 2026

| Step | Required Action | Key Benefit |

|---|---|---|

| Registrations | Get GB EORI & UK VAT if needed | Avoid declaration rejection |

| Tariffs | Apply TCA origin claims | Reduce customs duty to 0% |

| Declarations | Submit safety/security & customs entries | Faster border release |

| SPS | Pre-notify high-risk goods | Avoid holds at BCP |

| Licensing | Apply for controlled goods permits | Prevent clearance blocks |

| Record-keeping | Maintain invoices & declarations | Support audits & claims |

| Strategy | Use customs agents or CDS | Efficiency & lower admin |

Bottom Line

Post-Brexit Customs rules remain critical for UK importers as we approach 2026. UK businesses must register properly, classify goods accurately, and meet new safety and security requirements before goods reach the border. Strong record-keeping and strategic use of agents or simplified procedures help reduce delays and costs. Staying informed on evolving SPS agreements and digital systems enhances competitiveness. This checklist equips logistics teams to manage customs confidently and keep goods moving smoothly into the UK market.

Frequently Asked Questions

What is the key document for EU goods entering the UK?

An Economic Operators Registration and Identification (EORI) number starting with GB.

Do UK importers still pay customs duty on EU goods?

Yes, unless proof of origin under the TCA is supplied.

When are safety and security declarations required?

They must be submitted before goods reach the UK border.

Are pre-notifications needed for all food imports?

High-risk foods and animal products require pre-notification.

Will low-value import duty relief continue?

It is being phased out by March 2029.

Disclaimer

This article is for general information only and does not constitute legal, tax, or customs advice. Always consult HMRC or a qualified customs professional.