Table of Contents

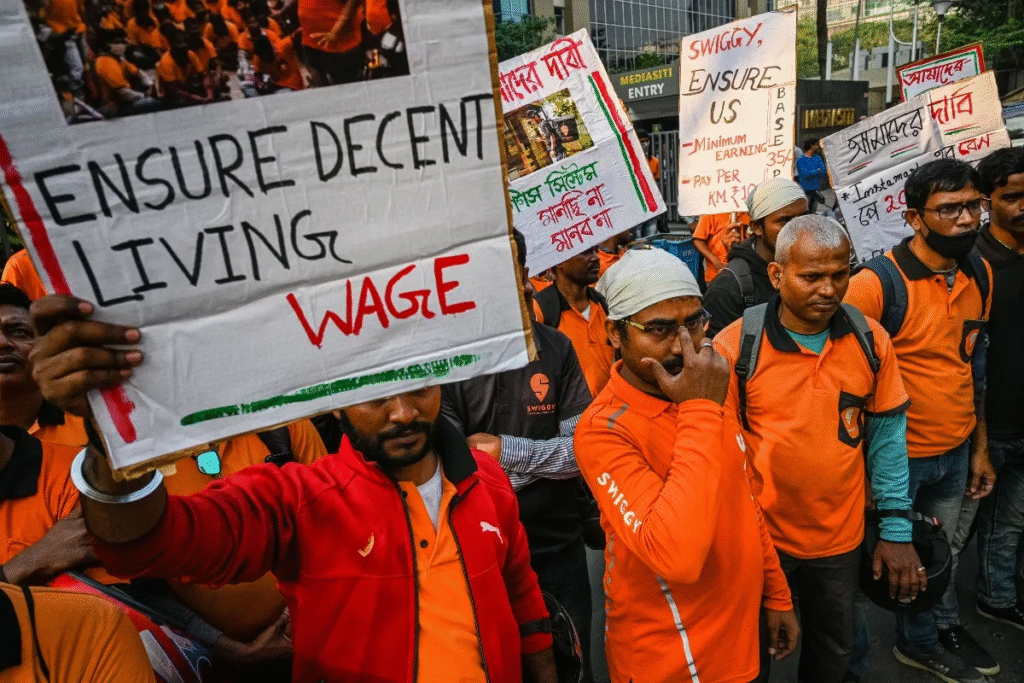

India has taken a landmark step: gig workers are now formally recognized under the country’s labour law. The Code on Social Security, one of four new labour codes enforced on 21 November 2025, explicitly defines gig workers and requires aggregators (platform companies) to contribute to a social security fund.

This is a major win yet, despite legal status, many gig workers still face unclear access to benefits like provident funds, insurance, and state support. As we unpack this change, we explore the gap between recognition and real, usable social protection.

What the New Law Means for Gig Workers

Formal Recognition Under the Labour Code

For the first time, India’s labour framework provides a legal category for gig and platform workers. The Code on Social Security (2020) now mandates that aggregators contribute 1–2% of their annual revenue, capped at 5% of payments made to these workers, into a government-managed welfare fund.

This change brings millions of delivery partners, ride-hailing drivers, and other app-based workers into a regulated system.

Creation of Social Security Boards

To oversee benefits, the law establishes Social Security Boards at both federal and state levels. These boards must include five representatives of gig workers, five from aggregators, plus government officials and experts. Despite this structure, it’s still unclear how much voice worker representatives will actually have. Implementation depends on both central and state governments, which raises a risk of uneven rollout. In short, legal boards exist but their real power remains to be seen.

The Limits of Social Protection

Ambiguous Benefit Design

Even with a social security framework, what gig workers will actually get remains uncertain. The law allows coverage under schemes like Employees’ State Insurance (ESIC), provident fund, and government-backed insurance. But we don’t yet know who is eligible, how contributions will be tracked across multiple platforms, or when payouts will begin. Without detailed rules, formal recognition may not translate into meaningful protection.

Implementation Challenges and State Variability

States now have major responsibility to design and notify the schemes that deliver benefits. Because labour policy is shared (a “concurrent list” issue), some states may move quickly, while others lag.

For example, in past efforts, Rajasthan stalled its gig-worker welfare legislation, while Karnataka acted faster. This raises a real concern: access may depend on where you live.

Legal and Practical Gaps Remain

Legal scholars and unions caution that gaps still persist. Gig workers remain classified as independent contractors, not full employees. That means they may lack guarantee of minimum wages, regulated hours, or enforceable labor rights.

Moreover, a 2025 legal review highlighted that although the Social Security Code exists, rules to operationalize it are not yet fully in place, delaying true coverage.

The risk: the law may be more aspirational than transformative.

Image Credits: Nasir Kachroo/NurPhoto / Getty Images

State-Level Developments: A Mixed Picture

State Regulations and Welfare Laws

Some states are already moving to strengthen protections. Telangana is preparing to pass its own Gig and Platform Workers Act, focusing on registration and welfare rather than fixed wages.

In Karnataka, its legislature passed the Platform-Based Gig Workers Act, 2025, establishing safety nets like occupational health coverage and mandated social security contributions. These state efforts show how local governments could fill gaps that the national code leaves open.

Central Reform on Social Security Schemes

On the national front, the government is actively reforming EPF, pension, and insurance schemes to align with the new labour codes. These changes aim to simplify compliance and extend formal benefits to gig workers across platforms. For more than 70 million existing employees under EPFO, the reforms could also improve portability and access. This policy momentum means that while benefit design is uncertain, systems to deliver them are being prioritized.

Key Risks and Concerns for Gig Workers

Here is a breakdown of major concerns facing gig workers under the new regime:

| Risk / Challenge | Description | Potential Impact |

|---|---|---|

| Delayed Implementation | Lack of detailed rules and definitions. | Workers may not see benefits for years. |

| Uneven State Roll-out | Social security boards depend on state-level action. | Workers in some states might lag behind. |

| Limited Voice | Worker representatives may lack real decision power. | Funds may not reflect gig workers’ priorities. |

| Contractor Status | Gig workers are not classified as employees. | No guaranteed minimum wages or leave rights. |

| Registration Barrier | E-Shram portal currently registers only a small fraction of workers. | Many may miss out on entitlements. |

Image Credits: NurPhoto / Contributor / Getty Images

Bigger Picture and Implications

We’re witnessing a turning point in India’s labour landscape. By legally recognizing gig workers, the government sets the foundation for social protection in a sector that employs more than 12 million people across delivery, ride-hailing, and on-demand services.

But recognition alone does not guarantee real benefit. The true test now lies in how schemes are designed, funded, and implemented and whether state boards deliver meaningful social security, not just legal status. For more insights, check out FedEx Signs Initial Deal as Harbinger Raises $160M Series C for Electric Trucks.

Bottom Line

India’s formal recognition of gig workers under the Social Security Code is a historic step forward. It mandates aggregator contributions and institutional structures, aiming to bring gig workers into the social safety net. But practical access to benefits like provident funds, insurance, and portable pensions remains uncertain. For real change, governments both central and state must move rapidly on rulemaking, board governance, and scheme delivery. Gig workers should push for transparency, registration via E-Shram, and active participation in Social Security Boards. Otherwise, legal status risks becoming a hollow victory rather than a real protection.

Disclaimer:

The information provided in this article is for general informational purposes only.