Table of Contents

Security weaknesses at ports are now one of the most significant risks to Global Trade in 2025, undermining supply chains that move over 80 % of world cargo by volume and more than 70 % by value. Ports, straits, and chokepoints such as the Suez Canal and Panama Canal handle essential flows for energy, food, and manufactured goods. Disruptions at these nodes can ripple across continents within days.

For example, rerouting vessels around the Cape of Good Hope pushed global ton-miles up 6 % in 2024, three times faster than growth in trade volume, illustrating how even strategic routing changes can burden logistics networks and increase costs.

Port security gaps range from physical cargo theft and smuggling to cyber intrusions and resource constraints that weaken surveillance. In Tanzania’s Dar es Salaam Port, 24 cargo-theft incidents were reported in 2023 and 19 in 2024, revealing persistent vulnerabilities that erode trust, raise insurance premiums, and slow cargo movements.

The Anatomy of Port Security Gaps

Ports are the gateways of Global Trade, yet they are often the most vulnerable points in supply chains. Breaches occur when inadequate surveillance, outdated technology, and procedural lapses allow unauthorised access to container yards or digital systems. Cargo theft remains a glaring issue: Dar es Salaam Port reported 24 theft cases in 2023 and 19 in 2024, despite CCTV and anti-theft measures, highlighting how persistent gaps can erode trade performance and deter investment.

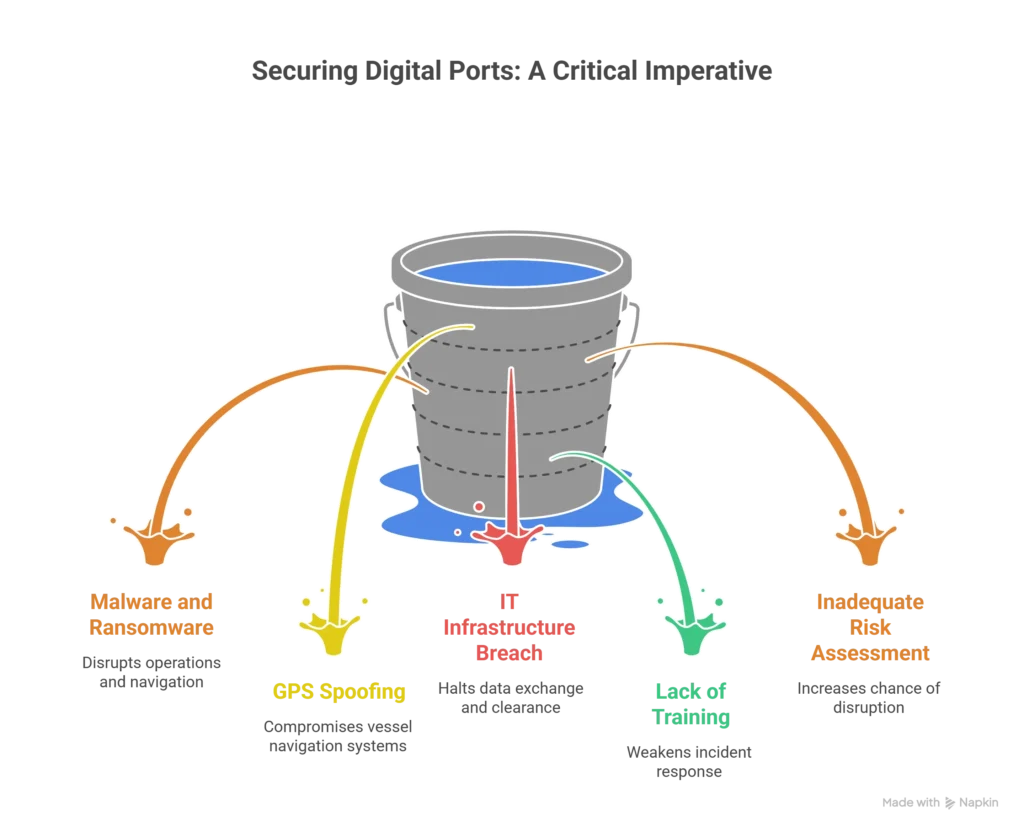

Cybersecurity represents another weak link. Maritime and port systems have faced increasing cyber attacks that disrupt cargo tracking and port operations, leading to delays and costly system restorations. Ports and shipping companies worldwide now must contend with threats that can halt electronic data interchange, undermine navigation systems, and affect vessel scheduling.

Physical and digital vulnerabilities interact to amplify risk. A facility with robust perimeter security but weak network protections may still succumb to a ransomware event that halts container handling. The lesson for logistics leaders is clear: security gaps at ports are multifaceted, and isolated fixes yield limited resilience in Global Trade networks.

Impact on Supply Chain Efficiency

Security failures at ports directly slow the flow of goods and inflate logistics costs. Berth times, a key efficiency metric, have worsened at major hubs; Ningbo-Zhoushan’s average berth waiting time jumped from 2.21 to 3.57 days in July 2025, a 61.5 % increase. Delays like these impose knock-on effects: demurrage charges climb, inland transport slots are missed, and retailers face stock shortages.

Chokepoint disruptions have wider consequences. By May 2025, Suez Canal traffic remained 70 % below 2023 levels due to rerouted vessels, forcing longer journeys around Africa and increasing fuel costs. (Such shifts compound congestion at alternative hubs, further stressing already stretched logistics networks.

Ports struggling with security also face higher insurance premiums and compliance costs. Shippers and carriers must absorb these expenses or pass them to customers, raising prices on goods. Effective risk mitigation, such as enhanced surveillance and threat detection, cuts dwell time and stabilises schedules. The clear takeaway: poor port security translates into tangible efficiency losses for Global Trade.

Port Security Risks Explained

Cargo Theft and Smuggling

Cargo theft and smuggling not only take goods but disrupt Global Trade through unpredictable supply chain interruptions. Persistent theft cases at Dar es Salaam Port show how even with surveillance systems in place, opportunistic criminal networks find ways to intercept and misappropriate cargo.

Table: Typical Port Security Incidents and Consequences

| Incident Type | Typical Cost Impact | Operational Effect | Recovery Time |

|---|---|---|---|

| Major Port Closure | $1–15 billion per day | 20–35 % capacity reduction | 2–8 weeks |

| Cybersecurity Breach | $50–300 million | System rebuilds, delays | 1–4 months |

| Piracy Incident | $1–7 million per vessel | Route diversions | Days to weeks |

| Strait Blockage | $10–25 billion per day | Commodity price volatility | 1–3 weeks |

Smuggling undermines customs revenue and distorts trade statistics. Gaps in container inspections can allow illicit goods to transit alongside legitimate cargo, eroding trust among trading partners. Security controls that focus only on revenue generation instead of holistic risk management may inadvertently leave gaps that international traffickers exploit.

Cybersecurity Risks in Port Operations

It is necessary to build multilevel systems to make the shipping terminal more secure. It will ensure that if one layer is breached, others remain intact to protect the trade.

Ports are increasingly digital; yet cybersecurity often lags. Malware, ransomware, and GPS spoofing can disrupt port operations, stalling cargo movement and compromising vessel navigation. Recent academic research highlights how ransomware attacks on major shipping companies caused widespread trade disruptions.

A breach in port IT infrastructure can halt electronic data interchange used for customs clearance, bill of lading submissions, and yard management systems. Delays cascade into congestion, increased fuel costs, and shipment re-routing. Unlike physical theft, cyber incidents may not be immediately visible but carry deep operational impact.

Port authorities must invest in training, incident response protocols, and resilient infrastructure to thwart cyber threats. Coordinated risk assessments that encompass both physical and cyber domains yield stronger defences and reduce the chance that a single breach will disrupt Global Trade flows.

Strategic Responses to Port Security Gaps

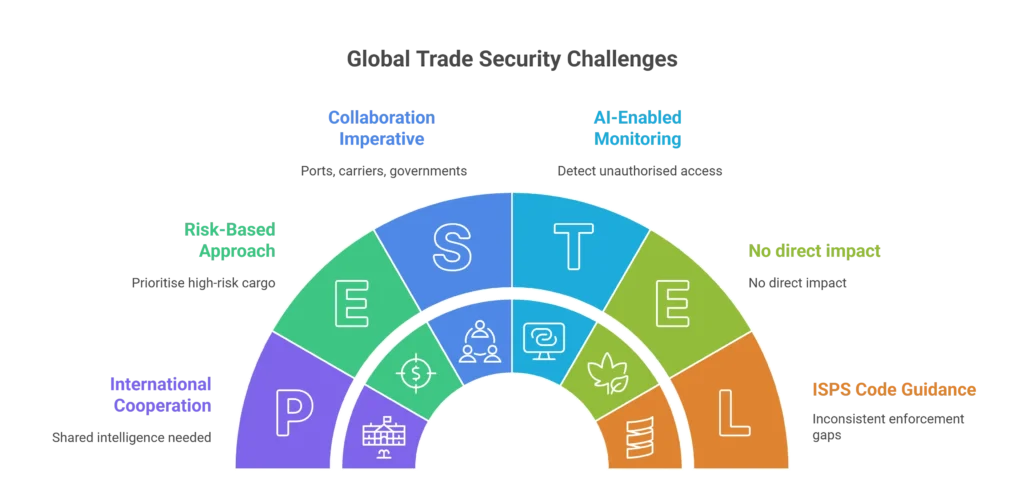

Closing security gaps requires a mix of technology, policy, and collaboration. Modern sensor networks and AI-enabled monitoring help detect unauthorised access and anomalies in cargo handling. Digital platforms that integrate customs, port authority, and carrier data increase visibility across the supply chain.

International cooperation is crucial. Standards like the International Ship and Port Facility Security (ISPS) Code guide baseline protections, but inconsistent enforcement leaves gaps. Shared intelligence among ports, carriers, and governments improves early warning and response.

Security upgrades must balance speed and thoroughness. Overly intrusive checks can slow cargo clearance, while lax controls invite exploitation. A risk-based approach that prioritises high-risk cargo and routes improves both security and throughput. For logistics professionals, the key takeaway is this: proactive, coordinated security measures protect shipments and sustain Global Trade continuity.

Bottom Line

Port security gaps are not peripheral to logistics; they are core risks to Global Trade. Cargo theft, smuggling, cyber vulnerabilities, and chokepoint disruptions manifest in measurable delays, higher costs, and stunted supply chain performance. Forward-looking security strategies, backed by technology and international cooperation, reduce delays and protect cargo integrity without crippling efficiency. Logistics leaders should prioritise security risk assessments, invest in resilient infrastructure, and adopt integrated monitoring systems.

Disclaimer:

This article is for informational purposes only and does not constitute legal, financial, or regulatory advice. Decisions should be based on professional guidance.