Table of Contents

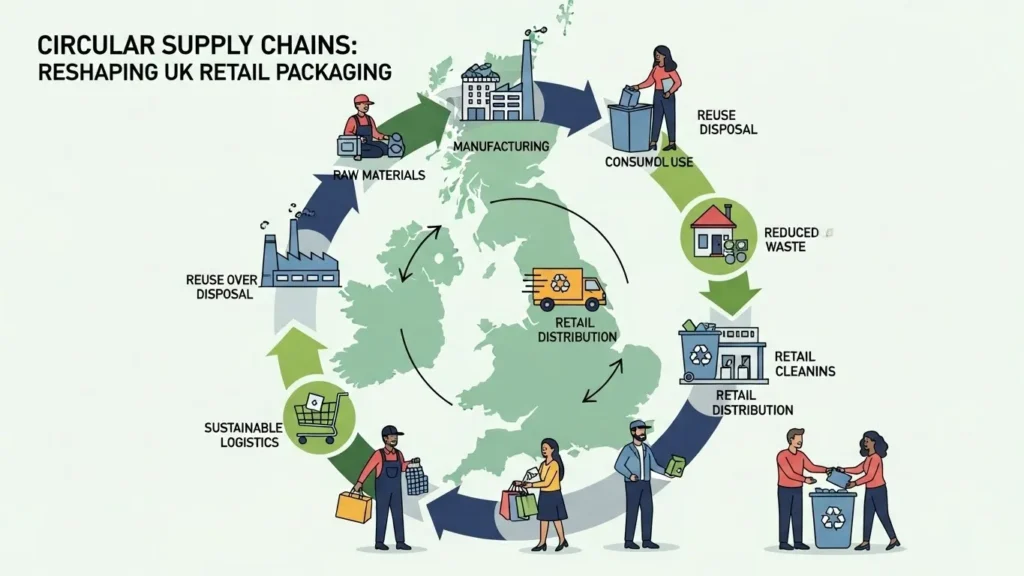

Circular Supply Chains are reshaping logistics across UK retail by reducing waste and boosting sustainability. In 2026, UK grocery retailers are actively exploring reusable packaging logistics to cut material use and costs while meeting tightening regulations on packaging waste. UK government policies, such as the extended producer responsibility framework, are driving firms to rethink linear supply models that rely on single‑use packaging.

The Waste & Resources Action Programme (WRAP) and Innovate UK are supporting nine major UK grocery brands in developing interoperable systems for reusable packaging, both in stores and online. These efforts aim to deliver substantial environmental benefits, including up to a 95 per cent reduction in CO₂ emissions for items shifted to reusable formats and potential savings on packaging cost liabilities.

Reusable logistics demand new operational models for collecting, cleaning, storing, and redistributing returnable packaging. For UK retailers, this often means coordinating with reverse logistics partners and investing in infrastructure to support seamless returns from consumers and stores back into the supply chain.

Why Circular Supply Chains Matter for UK Retail Logistics

Circular Supply Chains redefine how packaging moves through UK retail logistics by prioritising reuse over disposal. British consumers generate millions of tonnes of packaging waste each year, with packaging responsible for a large share of domestic plastic waste. Retailers now face regulatory pressure to reduce this waste due to evolving Extended Producer Responsibility requirements and impending deposit return schemes for containers.

In practice, this means investing in reverse logistics that bring packaging back from customers to cleaning and sorting hubs for reintegration into distribution networks. For grocery retailers, the transition can involve reusable crates, bottles, and containers designed to withstand repeated use and automated washing systems, supporting broader Sustainable Logistics initiatives.

The shift to circular logistics also influences warehouse operations. Reverse logistics increases complexity as returns must be tracked, cleaned, and restocked alongside traditional inbound and outbound flows. It requires new data systems to trace packaging lifecycle, optimise routes for collection and delivery, and reduce touches that add cost or delay. Retailers collaborating under shared frameworks aim to standardise return processes so that packaging from different brands can be handled effectively in shared facilities.

Business Case and Economic Incentives for Reuse

Circular Supply Chains deliver measurable economic returns when reusable packaging systems are scaled across UK logistics networks. Research by GoUnpackaged shows that achieving just 30 per cent reuse in UK grocery retail can deliver between £314 million and £577 million in net system savings yearly.

These savings stem from reduced demand for new materials, lower waste treatment costs and savings on Extended Producer Responsibility packaging fees. In addition, CO₂ emissions for the products involved could be cut by up to 95 per cent as packaging is looped back into distribution rather than discarded.

The business case improves further when logistics partners innovate around returnable systems. For example, reusable transport packaging such as pooled crates with protective features can reduce damage to goods, improve loading efficiency, and enhance Carbon Reporting by tracking emissions savings from fewer replacements and returns.

Investment in circular logistics also unlocks jobs in sorting, cleaning, and transportation hubs that support reuse. Modelling suggests that a move to a 30 per cent reuse system across the UK could create up to 13,000 net new jobs in reuse infrastructure and logistics operations.

Business case table: UK grocery reuse benefits at 30 per cent adoption (per annum)

| Metric | Impact | Source |

|---|---|---|

| Net system savings | £314–577 million | GoUnpackaged modelling |

| Packaging EPR cost reduction | £136 million | GoUnpackaged modelling |

| CO₂ emissions reduction | 95 % for reused items | GoUnpackaged modelling |

| Jobs enabled | ~13,000 | Reuse infrastructure model |

This data makes a compelling case for retailers and logistics partners to invest in circular strategies that leverage reuse for both sustainability and competitive advantage.

Logistics Challenges and Infrastructure Requirements

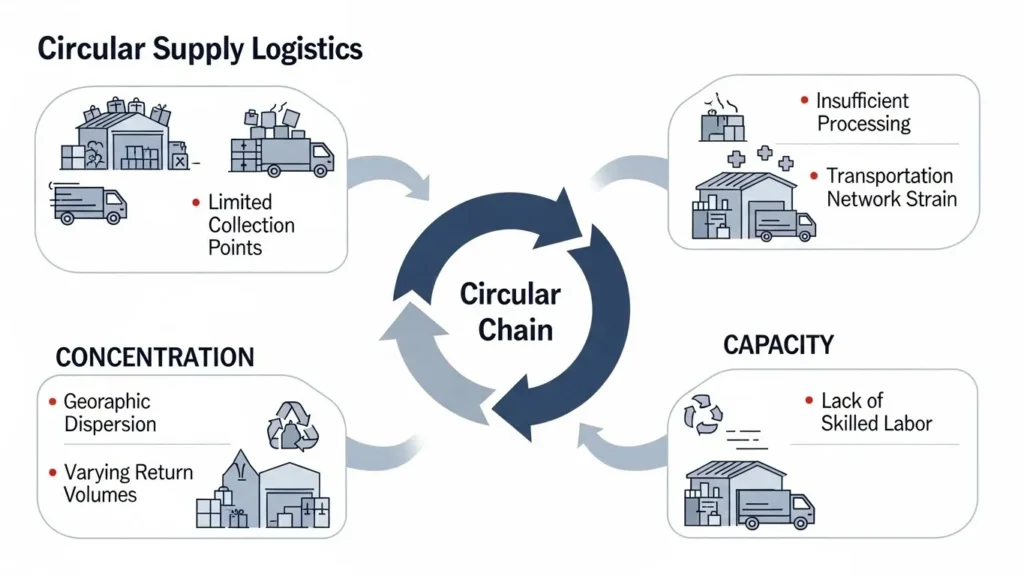

Implementing Circular Supply Chains in retail logistics presents concentration and capacity challenges that must be systematically addressed. Reusable packaging systems add complexity to logistics flows because they introduce return legs that must be managed alongside outbound delivery and retailer fulfilment. Unlike single‑use packaging, reusable items require inspection, sorting, cleaning and storage before they re‑enter forward logistics channels.

In the UK, shared return infrastructure and clear standards are not yet mature at scale. This can create bottlenecks if retailers operate independent return paths that do not interoperate. Coordinated frameworks such as the Reuse Packaging Partnership aim to tackle these by standardising collection points, return processes and shared cleaning facilities.

Reverse logistics also impacts transport planning. Packaging must be routed efficiently from customer return locations back into depots or third‑party hubs, often requiring dynamic routing, demand forecasting and real‑time data. Logistics teams rely on systems that track each reusable item’s lifecycle, retention rates and condition to decide when it should be refurbished versus recycled.

Regulatory compliance adds a layer of complexity. UK legislation, such as packaging waste reporting and upcoming deposit return schemes, influences how returns are tracked and recorded, making strong IT systems for data and compliance necessary, especially for operators involved in UK long-haul transport.

Case Study: Reuse Impact on UK Grocery Retail

Tesco’s pilot with a reusable packaging partner offers a real-world example of logistics change in action. In recent trials, Tesco introduced returnable reusable packaging for groceries in selected regions, with customers paying a refundable deposit for each item. Returned packaging was collected, cleaned and reintroduced into the supply chain, cutting reliance on traditional single‑use materials.

Early results showed strong customer uptake and insights on logistics flows that informed broader rollout planning. This case highlights how reuse systems can integrate with existing delivery operations and generate valuable data on return rates and cost impacts.

Emerging Logistics Solutions

As Circular Supply Chains evolve in the UK retail market, logistics providers are innovating to meet rising demand. Reusable transport packaging, such as RPCs (reusable packaging containers) and stackable crates, allows goods to flow through distribution and back again without damage or excess handling. Systems that support pooling services help retailers share reusable packaging inventory, reducing capital costs and improving utilisation.

Technology plays a key role. Digital tracking, RFID tagging, and mobile apps that enable customers to return packaging easily improve return rates and visibility across logistics networks. These technologies integrate with warehouse management systems (WMS) and transport management systems (TMS), allowing logistics teams to optimise routes, forecast return volumes, and reduce dwell time for reusable assets.

Customer behaviour and convenience are also critical. Initiatives that make return points accessible in stores and simplify returns for online orders help increase participation and ensure packaging enters circular loops rather than ending up in landfills or recycling streams.

Bottom Line

Circular Supply Chains in UK retail logistics are moving beyond theory into operational reality. With clear economic benefits, government backing, and collaboration among leading brands, reusable packaging logistics are becoming integral to how UK retailers manage sustainability and cost pressures. Structured reverse logistics, shared infrastructure, and strong data systems are essential. As retailers scale reuse beyond pilot schemes, these circular logistics networks will reduce waste, cut emissions, and drive competitive advantage in a more regulated market.

FAQs

What are Circular Supply Chains?

Systems where materials and products are reused, refurbished or recycled to minimise waste.

Why focus on reusable packaging logistics?

They cut waste, reduce costs and align with UK sustainability mandates.

How much could a UK retailer save annually?

£314 million to £577 million at 30 per cent reuse adoption.

Are UK retailers collaborating on reuse?

Yes, nine major grocery retailers signed a joint intent to explore reusable packaging systems.

What role do consumers play?

Consumers return packaging, enabling reverse logistics and reuse cycles.

Disclaimer

The content provided is for informational purposes only and is based on publicly available data.