Table of Contents

Bonded Warehousing is a critical customs strategy for UK importers and logistics professionals in 2026. It allows businesses to store imported goods without paying import duty and VAT upfront, deferring these charges until goods are released to free circulation or re-exported. In the UK, this procedure is part of the customs warehousing special procedure regulated by HM Revenue & Customs (HMRC) and defined under customs laws.

This duty-deferment tool is essential for managing cash flow, reducing upfront logistics costs and aligning tax payments with sales cycles. Goods held in a bonded warehouse remain under HMRC control and supervision until they exit the warehouse for domestic sale or are shipped abroad without entering free circulation.

In this article, we explore the UK regulatory framework, practical benefits, compliance requirements, and real case study data for logistics and warehousing professionals. The goal is to give a clear, actionable guide to leveraging bonded warehousing effectively under current HMRC regulations.

What is Bonded Warehousing in the UK?

Bonded Warehousing refers to HMRC-approved customs warehouses where imported goods can be stored under duty and VAT suspension.

A bonded warehouse is not an ordinary storage facility. It operates as a customs procedure where import duty and VAT are deferred until goods are released into the UK market. Businesses only pay these charges at the point of release into free circulation, or they pay no UK duty at all if the goods are re-exported. This model is particularly valuable for international trade, high-value goods, and e-commerce fulfilment operations that need to manage cash flow efficiently while scaling cross-border sales.

There are two main types of customs warehouses in the UK:

- Public Customs Warehouses – operated by third parties for multiple depositors.

- Private Customs Warehouses – operated by a business for its own goods.

HMRC Regulatory Framework and Compliance Obligations

HMRC governs bonded warehousing through the customs warehousing special procedure. This means facilities must be formally authorised by HMRC, and operators must maintain compliant systems.

To operate a bonded warehouse in the UK, a business must:

- Be established in the UK with a valid EORI number.

- Have robust inventory and stock control records.

- Provide appropriate site security and operational documentation.

- Supply HMRC with detailed commodity codes and business use cases.

- Potentially provide a customs guarantee or bond if not an Authorised Economic Operator.

Goods enter bonded status only after a proper import declaration is submitted via the Customs Declaration Service (CDS). Once the declaration is cleared, the goods must arrive at the bonded warehouse within five working days. This distinction is especially important when assessing operational control and compliance responsibilities in logistics models such as 3PL vs. 4PL, where accountability for customs processes and warehouse movements can differ significantly.

Customs procedures table:

| Requirement | What It Means | HMRC Reference |

|---|---|---|

| Warehouse Authorisation | Formal approval from HMRC to operate bonded warehousing | turn1search2 |

| Inventory Controls | Real-time stock tracking and records | turn1search4 |

| CDS Import Declaration | Entry of goods into procedure under customs control | turn1search0 |

| Site Security | CCTV, site plans and perimeter controls | turn1search2 |

| Customs Guarantee | Financial backing for deferred duty, if required | turn1search2 |

Duty and VAT Deferment: How It Works

Bonded Warehousing enables duty deferment that directly impacts cash flow and cost management.

When goods arrive from outside the UK:

- Import duty and VAT are not paid at the border if the goods enter a bonded warehouse.

- The goods are stored under HMRC supervision until removal.

- Duty becomes payable only when goods are released for UK sale or into free circulation.

- Re-exports incur no UK duty or VAT.

This means a business can defer payment until revenue is realised or avoid UK charges entirely on exported goods. The mechanism pairs well with a Duty Deferment Account (DDA) or Postponed VAT Accounting (PVA) to streamline cash management.

Strategic Business Advantages of Bonded Warehousing

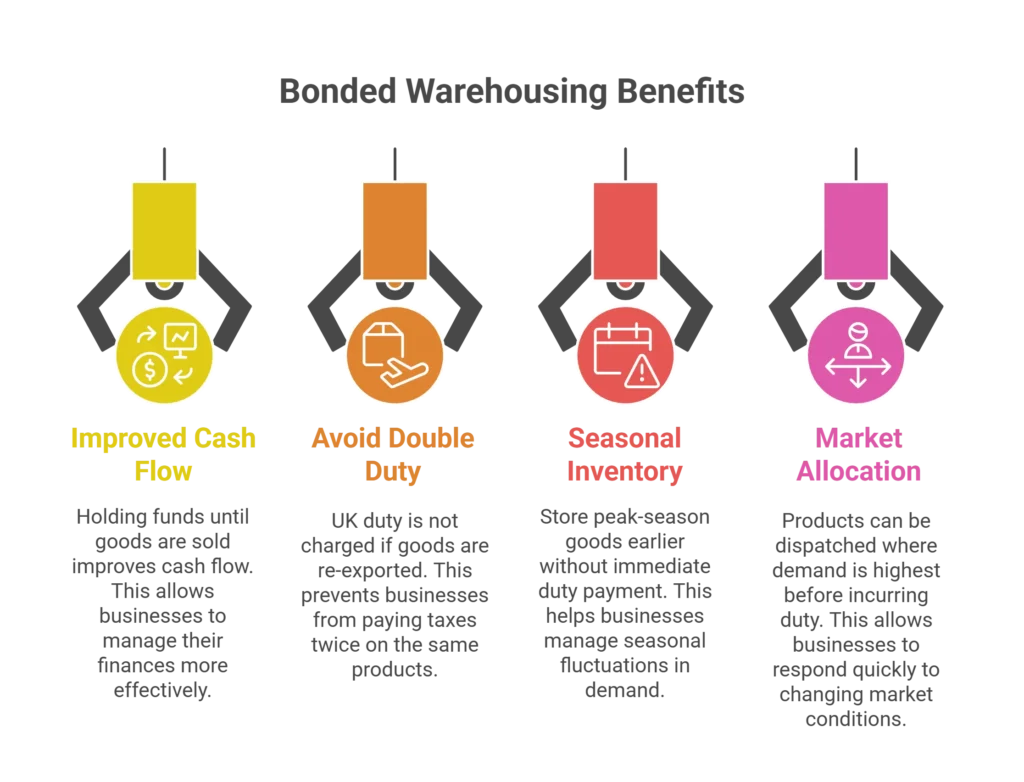

Bonded Warehousing offers several operational and financial benefits beyond simple deferment.

- Improved Cash Flow: Businesses hold onto funds until goods sell.

- Avoid Double Duty: If goods are re-exported, UK duty is not charged.

- Seasonal Inventory Management: Store peak-season goods earlier without immediate duty payment.

- Flexibility in Market Allocation: Products can be dispatched where demand is highest before incurring duty.

What Can Be Stored in a Bonded Warehouse?

HMRC permits non-UK goods that haven’t entered free circulation for bonded warehousing. These include:

- Goods liable for customs duty and VAT, such as electronics, apparel and machinery.

- Excise goods like alcohol or tobacco are subject to special excise warehousing rules.

- Goods awaiting import licences or permits at the time of import.

There are no broad time limits on how long goods can remain bonded, except for specific perishable goods.

Case Study: UK Electronics Importer 2025–2026

In 2025, a UK electronics importer used bonded warehousing near the Port of Felixstowe to optimise duty timing. By deferring £1.7m in customs duty across four quarterly stock releases, the company improved working capital by 12% compared to paying duty at arrival. Strategic timing also avoided duty charges on £450,000 of re-exported stock to EU partners. The importer maintained HMRC-compliant stock records and used Postponed VAT Accounting to eliminate upfront VAT payments. Result: profitability improved 8% and inventory turnover accelerated.

HMRC Duty Deferment Accounts and Bonded Storage Integration

Using a Duty Deferment Account (DDA) simplifies payment by allowing one monthly payment via Direct Debit instead of paying per consignment. Most traders don’t require a financial guarantee, but HMRC may request one if conditions merit.

For VAT, UK businesses can also apply Postponed VAT Accounting (PVA), allowing them to declare and recover import VAT directly on their VAT return instead of paying it upfront at the border. This improves cash flow and simplifies VAT management, especially for sellers using Shopify/Amazon Integration to manage cross-border e-commerce operations efficiently.

Common Risks and Compliance Challenges

Bonded Warehousing carries regulatory obligations:

- Strict record-keeping is mandatory; HMRC may audit records at any time.

- Misclassification of goods can trigger duty adjustment penalties.

- There are security and inventory controls required to prevent duty evasion.

Bottom Line

Bonded Warehousing is a powerful duty-deferment and cash-flow tool for UK importers under HMRC regulations. It allows businesses to defer paying import duty and VAT until goods are released for sale or re-exported, easing working capital constraints and reducing financial pressure. Compliance with HMRC’s authorisation and customs procedures is essential, with accurate inventory systems, CDS declarations, and regular reporting. When combined with tools like Duty Deferment Accounts (DDA) and Postponed VAT Accounting (PVA), bonded warehousing becomes more than storage; it becomes a strategic logistics asset in 2026. Businesses that master this procedure can unlock improved cash flow, reduced duty exposure and more flexible supply chain outcomes.

FAQs

What is a bonded warehouse?

A bonded warehouse is an HMRC-approved facility where import duty and VAT are suspended until goods enter free circulation.

Who authorises bonded warehouses in the UK?

HM Revenue & Customs (HMRC) authorises bonded warehouses.

When do I pay duty on bonded goods?

Duty becomes due when goods leave the bonded warehouse for free circulation.

Can goods be re-exported duty-free?

Yes, re-exported goods leave bonded storage without UK duty.

Is there a time limit for bonded warehousing?

Generally, no time limit applies unless goods are perishable.

Disclaimer

This content is for general informational purposes only and does not constitute legal, tax, or customs advice. Always consult HMRC or a qualified customs professional before making logistics or compliance decisions.