Table of Contents

Green Warehousing is now a compliance-driven priority for UK distribution centres, not a branding exercise. Energy costs, carbon regulation, and occupier pressure have aligned. As of 11 January 2026, non-domestic electricity prices in the UK average 24.1 pence per kWh, according to Ofgem data released in October 2025. Warehousing operators face sustained margin pressure. Energy-intensive HVAC systems and lighting typically account for 55–65% of total warehouse energy consumption.

UK regulations reinforce this shift. The Minimum Energy Efficiency Standards require commercial buildings to achieve EPC E or above, with a proposed EPC B target by 2030. Distribution centres that fail to upgrade face leasing and valuation risks. Solar photovoltaic systems and high-efficiency HVAC now deliver measurable returns while ensuring regulatory alignment. Warehousing occupiers are increasingly demanding assets aligned with net-zero targets and NABERS UK Energy Ratings.

This article explains how solar power and energy-efficient HVAC systems drive Green Warehousing in the UK. We focus on regulation, cost data, system performance, and real outcomes. Each section closes with a clear operational takeaway.

The regulatory drivers shaping Green Warehousing in the UK

UK Energy and Carbon Compliance Pressures

Green Warehousing in the UK is shaped by binding regulation, not voluntary targets. The Energy Act 2011 underpins MEES enforcement across England and Wales. From April 2023, landlords cannot legally lease warehouses rated EPC F or G. Government consultation published in September 2024 confirmed the intention to raise minimum EPC standards to C by 2027 and B by 2030 for non-domestic buildings. Distribution centres built before 2010 are most exposed.

Climate reporting adds further pressure. Companies exceeding £36 million turnover must report Scope 1 and Scope 2 emissions under the UK Streamlined Energy and Carbon Reporting framework. Electricity use in warehousing feeds directly into these disclosures. Local planning authorities also impose carbon reduction requirements for new logistics developments, especially across the Midlands and South East, reinforcing the importance of Sustainable Logistics practices.

Solar Power Is the Backbone of Green Warehousing

Rooftop Solar Capacity and Output for UK Distribution Centres

Green Warehousing strategies increasingly start with rooftop solar installations. Modern UK distribution centres typically offer 40,000–80,000 square metres of roof space. A 1 megawatt peak solar system requires approximately 6,500 square metres. At current irradiance levels, UK commercial solar systems generate an average of 950 kilowatt-hours per kilowatt annually.

A 2 MWp system, therefore, produces approximately 1.9 million kWh each year. In January 2026, electricity prices of 24.1 pence per kWh, which equates to £457,900 in avoided grid electricity costs annually. Installed costs for commercial solar in the UK range from £700,000 to £850,000 per megawatt, depending on roof structure and grid connection complexity.

Carbon Reduction and Grid Resilience Benefits

Green Warehousing also addresses carbon intensity and grid dependency. UK grid electricity carries an emissions factor of 0.182 kilograms of CO₂ per kWh, as published by DEFRA for 2025 reporting. A 2 MWp solar system generating 1.9 million kWh annually avoids 345,800 kilograms of CO₂. This reduction directly supports corporate net zero pathways.

Solar generation also improves resilience. Distribution centres are facing increasing grid congestion, particularly along logistics corridors near Rugby, Daventry, and Wakefield. On-site generation reduces peak demand exposure and mitigates grid constraint charges. Battery integration further enhances operational continuity during grid interruptions.

Energy-efficient HVAC systems in Green Warehousing

Why HVAC Dominates Warehouse Energy Use

Green Warehousing cannot succeed without addressing HVAC performance. UK warehouses require heating for worker welfare, frost protection, and product integrity. Traditional gas-fired warm air heaters operate at seasonal efficiencies below 75%. Older systems often lack zoning, causing energy waste across large volumes.

HVAC systems typically consume 30–45% of warehouse energy. Inefficient airflow, uncontrolled infiltration, and outdated controls inflate costs. As gas prices remain volatile, electrification through efficient systems aligns better with long-term cost certainty and decarbonisation targets, while supporting Circular Supply Chains by optimising resource use and reducing waste.

Modern HVAC Solutions for UK Distribution Centres

Energy-efficient HVAC in Green Warehousing relies on specific technologies. Air-source heat pumps designed for large volumes now achieve coefficients of performance between 3.2 and 4.1 in UK climates. Destratification fans reduce temperature gradients by up to 60%, cutting heating demand by 20–30%.

Building management systems with real-time sensors optimise airflow and temperature by zone. Demand-controlled ventilation reduces fan energy by up to 40%. When paired with rooftop solar, electric HVAC systems increasingly operate using self-generated power during daylight hours.

Integrating solar and HVAC for maximum Green Warehousing impact

System Coordination and Load Matching

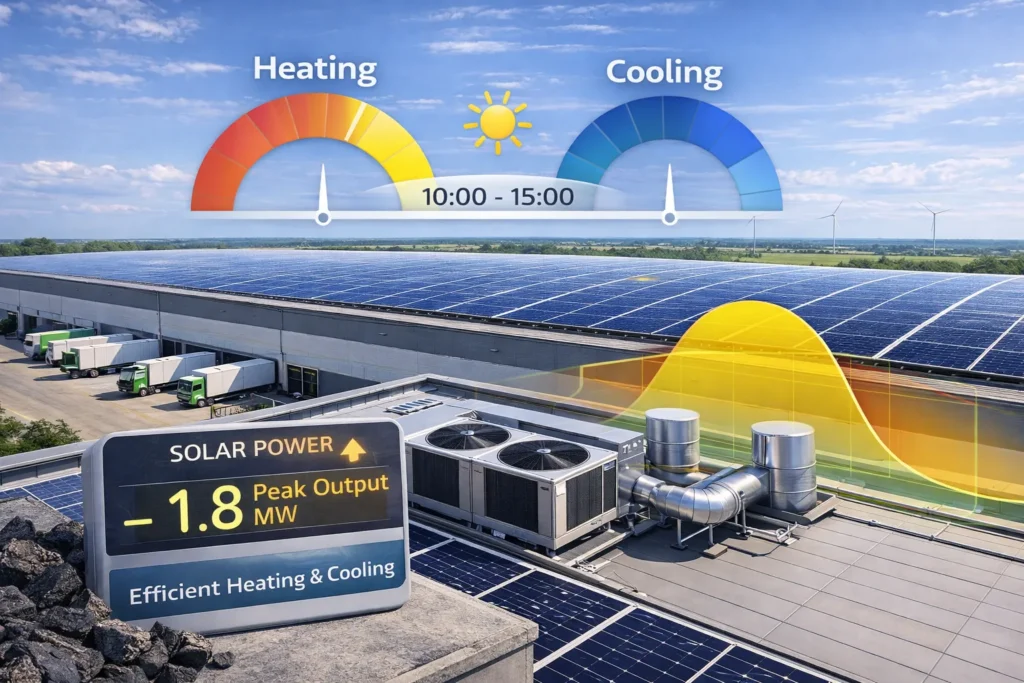

Green Warehousing delivers maximum value when solar and HVAC systems operate together. Solar output peaks between 10:00 and 15:00, aligning with warehouse operational hours. Electrified HVAC systems can prioritise heating or cooling during periods of high generation. Thermal mass within large distribution buildings supports load shifting.

Smart controls enable HVAC pre-heating or pre-cooling using solar energy. This reduces reliance on the grid during peak tariff windows. Battery storage further smooths demand curves, although many UK operators still prioritise direct consumption for faster payback.

Financial Incentives and Taxation Considerations

Green Warehousing investments benefit from UK fiscal support. Commercial solar qualifies for full expensing under the UK capital allowances regime, allowing 100% first-year tax relief. Enhanced structures and integral features, as well as rules for HVAC upgrades, also support HVAC upgrades.

The Climate Change Levy exemption applies to self-generated renewable electricity consumed onsite. Combined incentives improve project internal rates of return without reliance on subsidies. Power purchase agreements also allow zero-CAPEx solar adoption for tenants, supporting broader Electric Fleet Transition initiatives by reducing reliance on grid electricity for charging.

Case Study: UK Distribution Centre Solar and HVAC Upgrade

A real example comes from a 1.1-million-square-foot distribution centre operated by Tesco in Daventry, Northamptonshire. In 2023, Tesco completed a 4.9 MW rooftop solar installation combined with HVAC efficiency upgrades. The system generates 4.7 million kWh annually and supplies approximately 30% of the site’s electricity demand. Tesco reported annual carbon savings of 980 tonnes of CO₂ and energy cost reductions exceeding £1.1 million at 2024 prices. The project supports Tesco’s commitment to net-zero UK operations by 2035.

Operational benefits beyond compliance

Workforce Comfort and Productivity

Green Warehousing improves internal conditions. Stable temperatures and better air quality reduce absenteeism. Studies cited by UK logistics operators show productivity improvements of 2%-5% following HVAC upgrades. Improved daylight from solar-integrated roof designs further enhances wellbeing.

Asset Value and Leasing Resilience

Energy-efficient distribution centres command stronger tenant demand. CBRE UK data published in 2025 shows EPC A and B logistics assets achieving rental premiums of 6–8% compared to EPC D stock. Green Warehousing directly protects asset liquidity and valuation.

The takeaway is strategic positioning. Sustainability now underpins long-term asset performance in UK logistics.

Key Green Warehousing technologies and outcomes

Core technologies driving measurable results:

- Rooftop solar photovoltaic systems sized between 1–5 MW.

- Air-source heat pumps with high seasonal performance.

- Destratification fans and demand-controlled ventilation.

- Smart building management systems with real-time monitoring.

Primary outcomes for UK distribution centres:

- 25–40% reduction in total energy.

- 3.5–6 year capital payback.

- EPC improvement by two bands on average.

- Verified carbon reductions supporting SECR compliance.

Cost and performance comparison table

| Upgrade element | Typical UK cost | Annual savings | Payback period |

|---|---|---|---|

| 2 MW solar PV | £1.5 million | £457,900 | 3.3 years |

| HVAC heat pump retrofit | £420,000 | £96,000 | 4.4 years |

| Destratification fans | £85,000 | £38,000 | 2.2 years |

| BMS optimisation | £60,000 | £22,000 | 2.7 years |

Bottom Line

Green Warehousing has become an operational necessity for UK distribution centres. Rising energy costs, tighter regulations, and tenant expectations converge on the same solution set. Solar power and energy-efficient HVAC systems deliver predictable financial returns while ensuring compliance with EPC, SECR, and future carbon requirements. Data from operational UK sites confirm payback periods of under six years, with immediate cost-reduction benefits.

The practical path forward is clear. Assess roof capacity, electrify HVAC systems, and integrate controls to maximise self-consumption. Use available tax allowances to accelerate returns. Green Warehousing strengthens resilience, improves asset value, and supports workforce wellbeing.

FAQs

What is Green Warehousing in the UK?

Green Warehousing focuses on energy efficiency, renewable power, and compliance with UK carbon regulations.

Is solar viable for UK warehouses?

Yes. Commercial solar achieves 950 kWh per kW annually in UK conditions.

Do HVAC upgrades affect EPC ratings?

Yes. Efficient HVAC systems significantly improve EPC performance bands.

Are tax incentives available?

Yes. Full expensing and Climate Change Levy exemptions apply.

How fast is payback for upgrades?

Most UK projects recover costs within 3.5 to 6 years.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or engineering advice. Always seek professional guidance.