Table of Contents

The Electric Fleet Transition for Heavy Goods Vehicle (HGV) operators in the UK is shifting from concept to commercial reality in 2026. Logistics leaders recognise that decarbonisation is both a regulatory requirement and a competitive advantage. The UK government has committed to ending sales of new diesel HGVs by 2040 to cut transport emissions, which currently contribute around 18% of road transport CO₂ emissions. Infrastructure, not just vehicles, is the linchpin of this shift.

Without sufficient charging power, depot grid upgrades, and public high-capacity hubs, electric HGVs will remain under-deployed. Operators must understand the exact infrastructure requirements, costs, and policy levers to make the transition viable as part of a wider Sustainable Logistics strategy.

This article breaks down the structural, regulatory, and practical aspects UK HGV operators must navigate in 2026 to succeed in their Electric Fleet Transition.

Current Charging Infrastructure Landscape

Public EV Charger Growth and Limitations

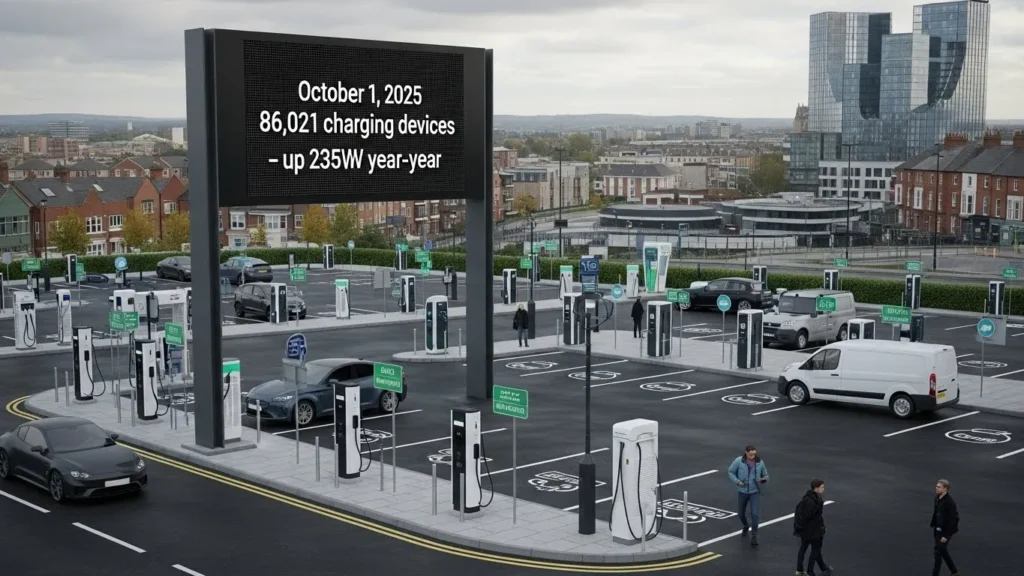

The UK’s public electric vehicle charging network reached 86,021 devices by 1 October 2025, up 23% year-on-year, with roughly 17,356 high-power chargers (≥50 kW). This shows infrastructure is expanding rapidly. However, most chargers are designed for cars and vans, not HGVs.

48% of chargers are at destination points, while only 9.4% serve en-route locations crucial for long-haul logistics. This imbalance underlines the Electric Fleet Transition real challenge: public infrastructure tailored to heavy logistics is still emerging.

| Metric | Value (as of Oct 1, 2025) |

|---|---|

| Total public chargers | 86,021 |

| ≥50 kW high-power chargers | 17,356 |

| Destination chargers | 41,390 (48.1%) |

| On-street chargers | 32,981 (38.3%) |

| En-route chargers (critical for HGVs) | 8,096 (9.4%) |

High-power chargers are vital for logistics, as electric HGV batteries often exceed 600 kWh and require ultra-rapid charging to minimise downtime. Unlike private car chargers, HGV depots and roadside hubs require 700 kW+ capacity, which demands significant grid reinforcement. Yet these are still scarce outside pilot programmes.

Policy Framework and Government Initiatives

Regulatory Context & Funding Programmes

Government policy underpins the Electric Fleet Transition by signalling future restrictions on diesel HGV sales and incentivising infrastructure build-out. In late 2025, the Department for Transport backed the Zero Emission HGV and Infrastructure Demonstrator Programme (ZEHID), allocating £200 million to both vehicles and charging hubs.

As part of this, demonstration fleets and nationwide charging networks with 6+ bays and 1,000 kW capacity are underway, demonstrating a serious commitment to infrastructure supporting heavy logistics.

The ZEHID scheme aims to accelerate direct experience with electric HGVs and build confidence among UK fleet operators. Policy clarity on grid connection standards and planning consent timelines is critical to reducing project lead times and costs.

Grants and Incentives

UK incentives extend to battery-electric trucks under the Plug-In Van Grant, covering up to 20% of vehicle costs for eligible commercial vehicles, including heavier trucks. These grants help lower the capital expenditure hurdles of switching fleets.

Depot Infrastructure Requirements

Power Upgrades at Hub Level

Depot electrification is often the first practical move for fleet operators. This requires:

- High-capacity grid connections (often 1 MW+ per vehicle).

- Transformer and switchgear upgrades.

- Smart charging with peak load management to avoid punitive tariff charges.

Electric HGVs demand charging power far above passenger EVs. Operators usually need fast chargers of 150 kW or more per bay, and megawatt chargers for long-range trucks. Where existing electricity infrastructure cannot support this load, reinforcement may take 12–18 months and cost tens of thousands of pounds per site. These factors must be budgeted early in planning.

Public Charging Hubs and Strategic Corridors

Electric Freightway and Other Public Hubs

Dedicated public charging infrastructure for electric HGVs is emerging through projects like the Electric Freightway, part of government-backed programmes and private partnerships. The first hubs are planned along key corridors like the A1(M) and M5, providing drive-through ultra-rapid charging specifically for HGVs. These hubs are designed with safety and efficiency in mind, offering the spatial layout and power levels HGV drivers need.

Public hubs reduce range anxiety and extend operational flexibility beyond depot charging. For national logistics players, access to these routes is essential to unlock cross-border operations and fulfil tight delivery windows.

Real UK Case Study: SAIC Maxus UK

SAIC Maxus UK documented how a commercial fleet successfully integrated electric vans and light trucks. While not HGV-level electrification, their case study shows systematic planning, infrastructure audit, and staged charging deployment enabled smooth transition and improved sustainability reporting. This concrete example highlights how logistics operators manage charging station installation, route optimisation, and staff training to support electrified fleets. Real-world data underscores that careful planning accelerates operational readiness and cost optimisation in fleet electrification.

Economic and Operational Considerations

Total Cost of Ownership (TCO)

Electric HGVs often have higher upfront costs than diesel equivalents, but lower running costs over the vehicle’s life. Fuel savings from electricity over diesel can be substantial where grid tariffs are well managed. However, depot grid upgrades and high-power charging infrastructure increase initial investment. Operators must model scenarios that include:

- Electricity tariff optimisation.

- Non-fuel operating savings (maintenance).

- Residual value forecasts for electric HGVs.

With most fleets operating on thin margins, the Electric Fleet Transition only makes sense with robust TCO models backed by real data from trials and initial deployments.

Grid Connection and Planning Challenges

Grid connections for electric HGV chargers require engagement with Distribution Network Operators (DNOs) well ahead of project start dates. A lack of grid capacity in rural industrial estates is a common blocker. Estimates suggest connecting multi-megawatt charging stations can cost £100,000+ and take 9–12 months without early planning. These realities must factor into logistics capital allocation decisions.

Strategic Takeaways for UK HGV Operators

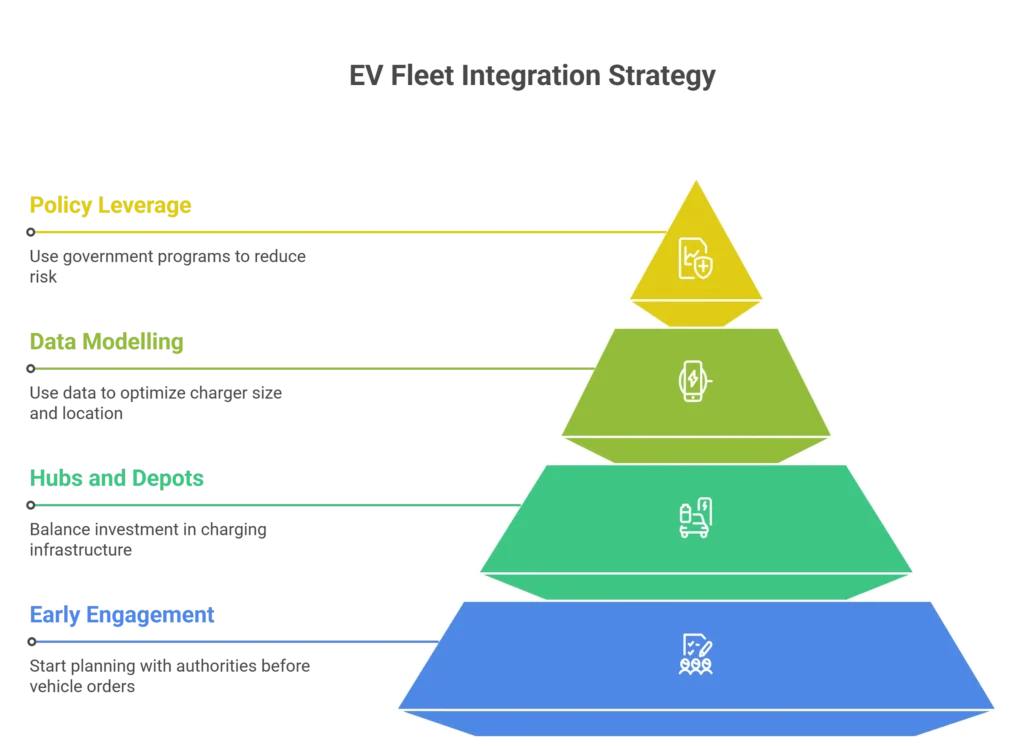

- Early engagement: Start grid connection and planning with local authorities and DNOs before vehicle orders are placed.

- Hubs and depots: Balance investment between depot charging and access to public hubs where possible.

- Data modelling: Use route and load data to size chargers and select locations that minimise downtime.

- Policy windows: Leverage government programmes, grants, and demonstrator insights to reduce risk.

Bottom Line

The Electric Fleet Transition for UK HGV operators is progressing but constrained by infrastructure readiness, grid capacity, and cost barriers. The landscape in 2026 shows growth in car and van charging infrastructure, but dedicated high-power charging tailored to HGVs is still emerging through government-backed demonstrators and private partnerships. Operators who align early with policy, understand exact infrastructure needs, and plan grid connections will unlock the greatest operational and sustainability value.

Frequently Asked Questions

What power level do HGV chargers typically require?

Electric HGVs often require ultra-rapid chargers of 700 kW or higher to minimise operating downtime.

Is there a government deadline for ending diesel HGV sales?

Yes, new diesel HGV sales are set to end by 2040 under the UK net-zero policy.

Can small hauliers get grants for electric trucks?

Yes, UK grants can cover up to 20% of the cost of eligible electric commercial vehicles.

Are public charging hubs available for HGVs now?

A limited number of dedicated HGV charging hubs are under development in 2026.

Do grid connection upgrades delay deployment?

Yes, necessary grid upgrades can take up to 12–18 months without early planning.

Disclaimer

This article is for informational purposes only and reflects UK logistics regulations.