Table of Contents

Digital Customs Declarations are now central to UK trade, reshaping how goods move into and out of the country. The key system behind this shift is the Customs Declaration Service (CDS), HM Revenue & Customs’ (HMRC) digital platform for all import and export declarations. CDS replaced the older Customs Handling of Import and Export Freight (CHIEF) system, which had been in use for nearly three decades. All UK traders must now use CDS for customs declarations, and CHIEF ceased handling both import and export declarations by March 31, 2023.

We see Digital Customs Declarations speeding up clearance processes, enhancing compliance, and aligning UK trade with modern global standards. The system supports precise data entry, tariff calculations, duty payments, and licensing requirements. It also integrates more effectively with safety and security electronic declarations for imports from the EU.

For UK businesses, CDS is more than a system change; it’s a trade accelerator. The platform supports detailed reporting services launched in November 2025, including the new Get Customs Data for Import and Export Declarations reporting tool, which streamlines processes for International Freight Forwarding.

This article unpacks what Digital Customs Declarations mean today, with data, context, and clear, actionable takeaways for UK logistics professionals.

What the Customs Declaration Service (CDS) Is and Why It Matters

A New Foundation for Digital Customs Declarations

The CDS is the UK’s single, unified digital platform for submitting customs declarations to HMRC. It replaced CHIEF and covers import and export declarations, tariff and duty calculations, and licensing obligations.

CDS went live in phases from 2018 and became fully mandatory for all import declarations by 30 March 2024 and for export declarations by 4 June 2024.

Digital Customs Declarations through CDS:

- Eliminate paper-based filings.

- Reduce data errors with electronic validation checks.

- Support compliance with UK trading rules established post-Brexit.

These advancements align with the UK’s broader Single Trade Window vision for 2025, ensuring government departments use shared data to speed up border processes.

In practice, traders must register with HMRC, hold a GB-starting EORI number, and complete declarations online or via approved software. End-to-end digital data exchange means fewer bottlenecks, clearer audit trails, and faster clearance.

Key Features of Digital Customs Declarations Through CDS

Digital Customs Declarations via CDS demand structured data for each shipment. Traders must supply information such as commodity codes, tariff procedure codes, and accurate valuation metrics.

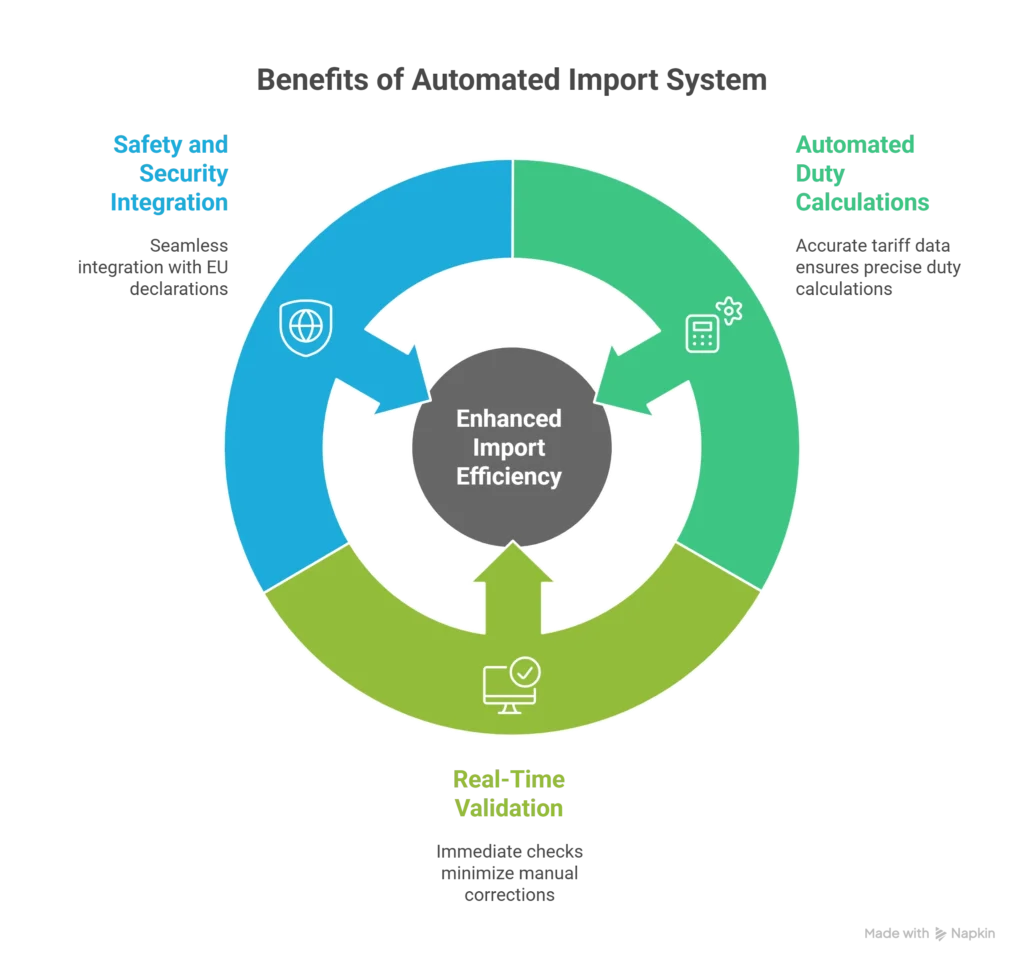

Key benefits include:

- Automated duty calculations based on accurate tariff data.

- Real-time validation reduces the need for manual corrections.

- Integration with safety and security declarations for EU imports.

The platform’s structured reporting feeds the new Get Customs Data for Import and Export Declarations service, introduced on 13 November 2025. This free HMRC service helps traders monitor declaration accuracy, assess declaration history, and support audits.

Table: CDS Data Elements and Key Fields

| Data Field Category | Purpose | Example Use |

|---|---|---|

| Commodity Codes | Classifies goods for tariff and duty | Electronics tariff classification |

| Procedure Codes | Indicates trade process applied | Temporary admission or export relief |

| Valuation Fields | Calculates customs value for duty | CIF or FOB valuation |

| Licensing & Certificates | Compliance with controls | Phytosanitary certificates |

Successful Digital Customs Declarations depend on accurate data and trained users. This precision streamlines border processes, reduces costly delays, and improves efficiency in Container Shipping operations.

UK Market Impact of Digital Customs Declarations

Logistics Performance and Trade Efficiency

The move to Digital Customs Declarations has transformed UK supply chains. Before CDS, CHIEF struggled with modern reporting requirements and complex post-Brexit compliance. CDS is more scalable, flexible, and secure, addressing these limitations.

For UK trade:

- Declared goods move through customs with less manual intervention.

- HMRC can enforce compliance more efficiently.

- Logistics operators benefit from powerful reporting and tracking tools.

The Get Customs Data reporting service launched in late 2025, tracking import/export trends and allowing businesses to spot compliance issues early.

CDS also supports the UK’s safety requirements for EU imports. From 31 January 2025, goods arriving from the EU require Safety and Security (ENS) declarations, a critical addition to Digital Customs Declarations.

Together, these digital processes reduce border friction, support faster turnaround times, and improve transparency across UK Pallet Networks and other UK logistics networks.

Challenges and Adoption Trends with Digital Customs Declarations

Despite clear benefits, many UK logistics teams faced challenges during CDS adoption. Early service issues and maintenance windows required planning to avoid declaration submission delays. HMRC confirmed service stability improvements as of 16 December 2025.

Key industry challenges:

- Data complexity: Ensuring correct tariff and procedure codes.

- System training: Users need strong digital skills for declaration accuracy.

- Software integration: ERP systems require seamless API connections.

The new Get Customs Data reporting service experienced initial limitations during beta tests (e.g. missing XI EORI data), indicating incremental improvements remain essential.

However, adoption statistics show a progressive shift to digital workflows, with major logistics providers reporting smoother customs processing in 2025. This steady digital uptake improves overall trade performance and reduces clearance times, particularly for sea and air freight shipments.

Case Study: UK SME Improves Clearance Times with Digital Customs Declarations

In 2025, a UK electronics exporter based in Manchester integrated CDS-ready customs software into its supply chain. Before the upgrade, the company averaged 48 hours of clearance delays due to inaccurate CHIEF filings and manual rework. After full adoption of Digital Customs Declarations through CDS and automated data validation, clearance times reduced to 12 hours per shipment.

Strategic use of the Get Customs Data reports allowed proactive error correction and ensured compliance with tariff and ENS requirements. The company recorded a 75 % reduction in customs-related delays by September 2025. This demonstrates the measurable benefits of a modern, digital customs process in the UK market.

Best Practices for Leveraging Digital Customs Declarations

To make the most of Digital Customs Declarations via CDS, UK logistics teams should:

- Automate data capture using software that integrates with CDS APIs.

- Train staff on key UK tariff codes and CDS data elements.

- Use reporting tools such as the HMRC Get Customs Data service.

- Stay updated on CDS instructional changes (most updated December 2025).

These actions reduce errors, accelerate border clearance, and ensure compliance with evolving UK customs legislation.

Bottom Line

Digital Customs Declarations, powered by the UK’s Customs Declaration Service, are transforming trade efficiency in 2025. The shift from CHIEF to CDS has modernised customs compliance, reduced delays, and improved supply chain visibility. By embracing digital data standards, automated workflows, and HMRC reporting tools, logistics teams can cut clearance times and enhance trade competitiveness. Actionable steps like staff training, accurate data capture, and regular reporting review will further unlock the benefits of a fully digital customs process.

FAQs

What are Digital Customs Declarations?

Structured electronic submissions of import/export data to HMRC via CDS.

When did CDS fully replace CHIEF?

Import declarations by March 2024 and export declarations by June 2024.

Do all UK traders need CDS?

Yes, all importers and exporters must use CDS for customs declarations.

What is the Get Customs Data service?

A reporting tool for CDS import/export data was launched in November 2025.

Does CDS integrate with safety declarations?

Yes, it supports safety and security (ENS) import filings.