Table of Contents

Warehouses are no longer dark, back-of-house storage hubs. In 2025, they have become strategic data nodes that drive supply chain visibility, uptime, and competitive advantage. The global warehousing and storage industry was set to exceed USD 1.17 trillion in value by the end of 2025 as technology reshapes traditional logistics functions. Warehouses that deploy next-generation systems and real-time tracking outperform peers on accuracy, throughput, and customer satisfaction. Industrial visibility no longer centres on static stock counts. It now means end-to-end transparency from inbound receipt to last-mile dispatch.

Today, more than 90 % of modern warehouses plan to use or are using Warehouse Management Systems (WMS) capable of real-time analytics and automation integration. Leading operators are combining robotics, AI, and IoT to reduce errors and create a digital audit trail for inventory, labour, and order flows. Visibility has become both a risk mitigator and a performance lever that fuels faster fulfilment, lower cost, and better service.

Why Visibility Matters in Modern Warehouses

Visibility in warehouses refers to real-time insights into inventory, workflows, and system performance across the facility. The modern concept goes beyond simple stock tracking to include labour, equipment, and environmental data. Visibility bridges physical events in a warehouse with digital reporting and analytics.

By 2025, approximately 4.28 million warehouse robots are expected to be deployed globally, supported by AI and automation platforms that feed structured performance data into dashboards and decision systems. This influx of smart equipment has accelerated how quickly facilities can detect disruptions and correct them before they affect delivery commitments.

To stay visible, warehouses use sensors, RFID tags, voice-guided picking, and connected vehicles to collect granular data at every task stage. This data empowers managers to spot bottlenecks, improve accuracy, and demonstrate fulfillment performance against KPIs like pick-rate, error-rate, and cycle time.

Key Technologies Driving Warehouse Visibility

The shift to visible warehouses is driven by technologies that capture, process, and present data in actionable formats. Warehouses investing in these tools are the ones pulling ahead.

| Technology | Role in Visibility | Benefit |

|---|---|---|

| WMS with AI | Central intelligence hub | Improves planning and exception handling. |

| IoT sensors | Device-level data collection | Tracks conditions and location in real time. |

| Robotics & AMRs | Automated task execution | Reduces manual errors and reports status continuously. |

| Predictive Analytics | Forecasts demand and failures | Minimises downtime and stockouts. |

Today’s top warehouses are using WMS systems as digital nerve centres that integrate multiple technologies and provide data-driven alerts and workflows. An AI-empowered WMS tracks zones, assigns tasks, and highlights discrepancies in labour or throughput as they happen.

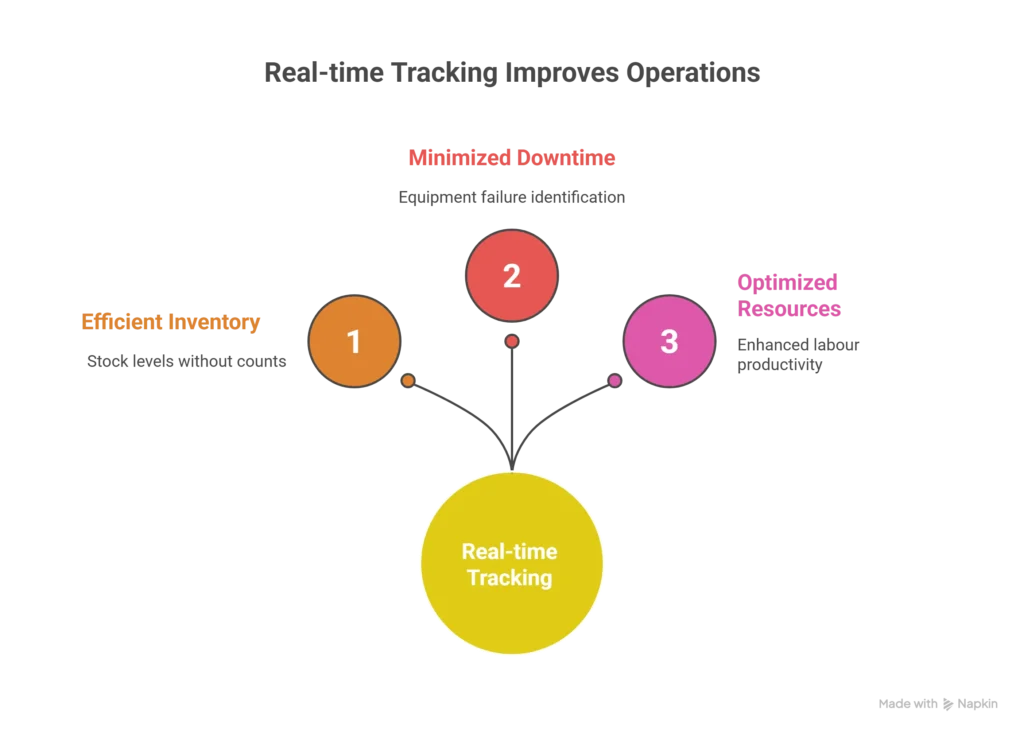

Real-Time Tracking and Operations Control

Traditional warehouses still rely on periodic inventory checks and paper logs. In contrast, competitive facilities use live location systems and sensor networks to see every move. For example, ambient IoT sensor initiatives now tracking millions of pallets show how real-time data reduces manual checks, improves stock accuracy, and accelerates decision cycles.

Real-time tracking gives managers visibility into:

• Stock levels without manual counts.

• Equipment performance before failures.

• Labour productivity across shifts.

Warehouse teams can resolve exceptions faster and provide stakeholders with up-to-date fulfilment statuses. This transparency improves safety and reduces costly mis-picks.

How Data Improves Warehouse Performance

Data without context is noise. Forward-looking warehouses convert data into meaningful performance indicators and actionable plans. Real-time metrics help operations teams focus on bottleneck zones and resource gaps. For instance:

• Order cycle time tracked hourly reduces late shipments.

• Inventory age reporting prevents obsolescence.

• Utilisation metrics optimise rack and floor space.

Predictive analytics uses historical data to forecast disruptions and demand surges. These forecasts allow warehouses to allocate labour and equipment before issues occur, rather than reacting after breakdowns. By turning data into decisions, warehouses reduce waste and enhance service reliability.

A new Lumenalta study of 920 logistics professionals paints a clearer picture. While the majority are talking about visibility, only 6 percent of organizations report having full operational awareness across their networks. That leaves 94 percent operating in the dark, at least some of the time. These gaps may seem small in isolation, but they add up quickly.

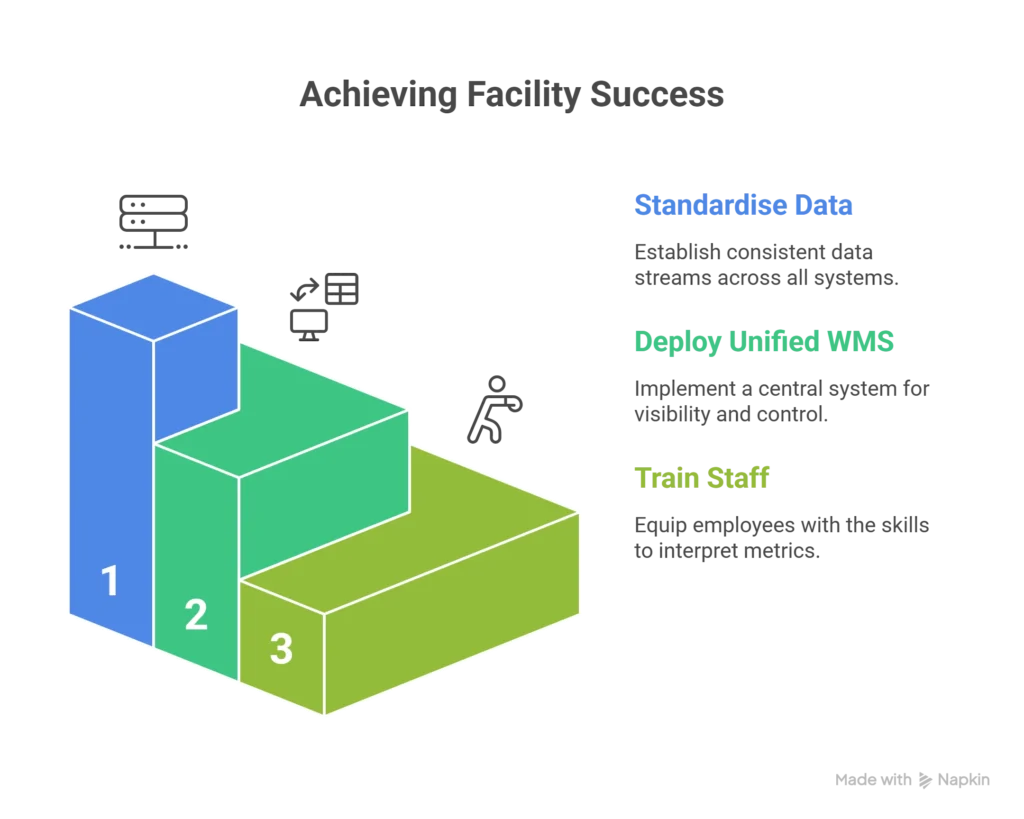

Overcoming Visibility Challenges

Despite clear benefits, many warehouses struggle to achieve full visibility. Common challenges include:

• Fragmented systems with siloed data streams.

• Integration issues between legacy and modern tools.

• Skills gaps in interpreting analytics.

Successful facilities focus on a phased approach:

- Standardise data streams across systems.

- Deploy a unified WMS as the visibility hub.

- Train staff on interpreting metrics and alerts.

These strategies ensure that visibility becomes a sustainable capability, not a short-term project. Premium facilities emphasise change management alongside tech deployment to achieve lasting results.

Bottom Line

Warehouses that lead today do so by turning visibility into a competitive advantage. They invest in connected systems, real-time tracking, and data analytics to manage inventory and performance proactively. As technology costs fall and adoption rises, visibility will separate resilient warehouses from those stuck in the past. Focus on integrated platforms, meaningful metrics, and staff skills to ensure your warehouse doesn’t just collect data, it uses it to improve every operational decision.

Disclaimer:

This article is for informational purposes only and reflects industry data available as of 2025.